Happy Sunday!

This week, the news was us. We’re here now! And now you are, too, so take a look around: we’ve got a new name, a new platform with a custom typeface, and some sweet new publication logos (food for all the Serif Stans out there). Plus, a founder’s letter from Dan and Nathan, explaining the reasoning behind our move, and why it goes deeper than just a rebrand.

Being the News was fun. It also lasted only a few hours. For us, January 26th may always be Launch Day but for many others, it’ll be Stonk Day. Or the Day Melvin Stood Still. Or…something. You’ve probably got a better name; please do leave any in the comments. GameStop’s meteoric rise may have been in the works for months, but its break into the mainstream has dominated the final week of this month.

Takes are flying fast and thick: this is a righteous uprising; it can only end badly; it has everything to do with not enough sex (?). And while we can’t ignore the hits of pure dopamine we get from watching hedge fund managers sweat on their CNBC Zoom feeds, characterizing this as a full-on rebellion feels maybe overstated. For one: stocks cost money. For another: though we don't doubt the sincerity of the movement, encouraging online day traders to pile on feels like an easy way for certain people whose pockets need no extra padding to grab some easy cred—or make even more money. (Some actual GameStop workers, it’s worth noting, aren’t particularly jazzed about their employer’s sudden jump in popularity.)

None of that is to say this phenomenon should be ignored as a call for more level ground in the market. But it’s worth, dare we say it, thinking through. It will be interesting to see where things end up when the dust settles.

But let’s put a stop to the GameStop takes and get back to us. That’s what this space is all about, anyway—and there’s plenty to round up in this inaugural week of the Every Sunday Digest: A look at the run-up and road forward for this here site from its founders; a passion economy palate cleanser; and your first update from The Prediction Game, at the end of an absurdly eventful month that still managed to be predictable to some. The point being: new home, same digest.

Until we have more to say...

What We Published

The lowdown on this week’s output: 5 pieces of writing, 3 podcasts, and 2 live conversations.

📝 ARTICLES 📝

Introducing Every

by Dan Shipper and Nathan Baschez

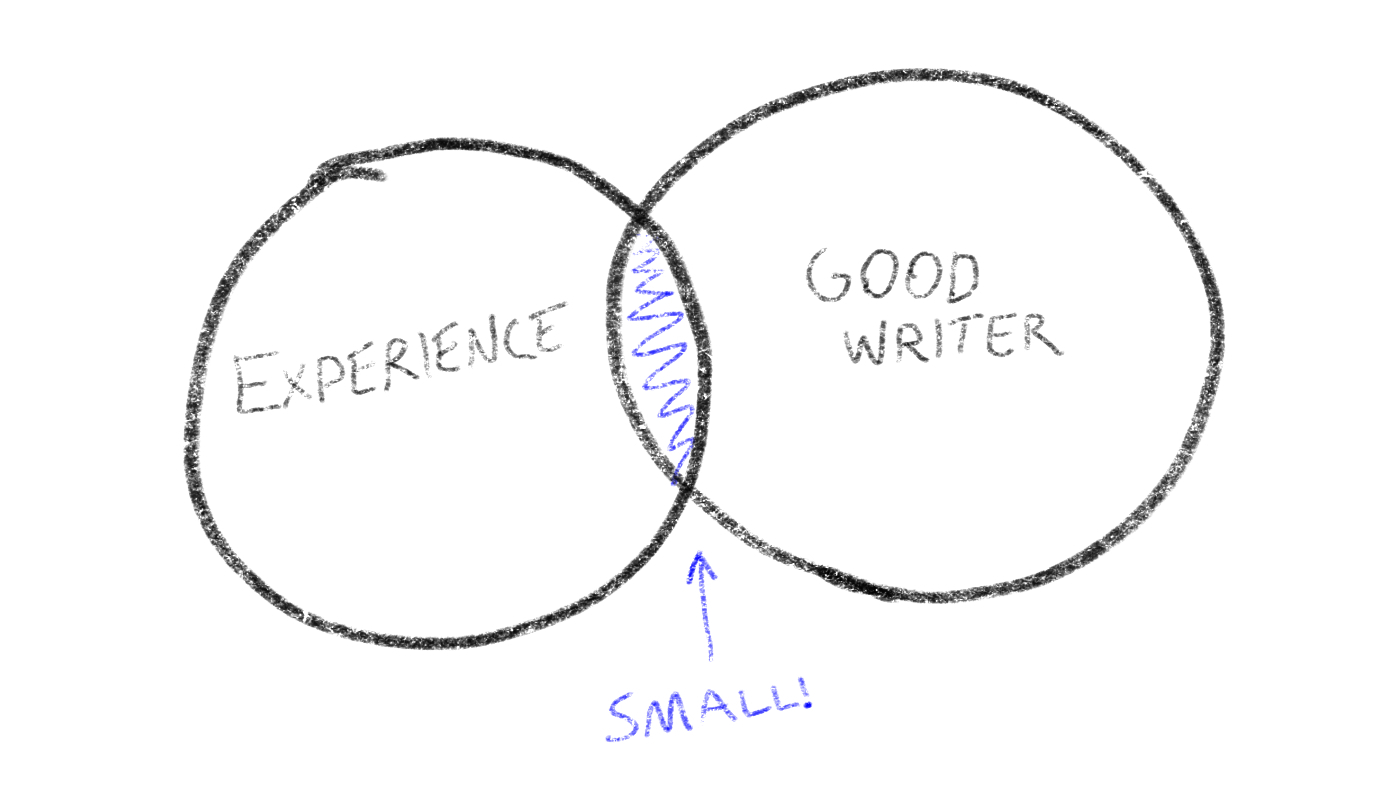

Although it’ll be up on the site for years to come, the spirit of this letter from our co-founders resonates even more at the end of our first full week as Every. Whether you're looking for an explanation behind the new name, or you want to know what it actually means to be structured as a writer collective, your answers are here—but Dan and Nathan's writing here goes beyond filling in the blanks. In typical fashion, it becomes a warmly analytical look at why great business writing is so hard to find, and why our relocation is part of an attempt to make doing so easier—and make writers feel less alone.

Read (15 minutes)

Finding the Truth

by Dan Shipper in Superorganizers

We should all be reading as much as Dan is—not least because it might help us write about our literary intake as well as he does. Here, he starts by identifying a problem with the books he's been reading: they seem to contradict each other without acknowledging it. That's fine enough, but when you're dealing with nonfiction books that recommend new and different strategies for rewiring your brain, how do you know what to try? Or how long to do it for? These questions don't have simple answers—and maybe we shouldn't tie ourselves in knots looking for them. Or, as Dan writes, "So what if the edges of our brains are messy?"

Read 🔒 (9 minutes)

A Local News Revival

by Adam Keesling in Napkin Math

In a time where everyone and their cousin is cashing in on the newsletter boom, here is a more granular look at one of the phenomenon's more intriguing use cases: local newsletters. That's right, newsletters, not papers—in fact, that's a crucial part of this essay's meticulous construction. Reaching back to understand "why newspapers died," Adam lays out the qualities that newsletters might be able to excavate and ultimately improve on. This being Napkin Math, the argument is the opposite of Pie in the Sky; by the time you reach the paragraphs with as many numbers as letters, you'll know you're reading a fascinating piece of business theory bolstered by clear, strong research.

Read 🔒 (11 minutes)

Did We Create a Rip in the Fabric of Spacetime?

by Andre Plaut in The Prediction Game

The first dispatch from the Prediction Gamemaster is riddled with eyebrow-raisers: Way back in 2020, someone predicted our newest former President's social media ban—to the day. On the other end of things, two people are banking on 2021's big surprise music release coming from...Michael Jackson. As for stock predictions? There is, of course, still time to finish the year on the money, but this week found the popular predictions of AMC's bankruptcy and Bitcoin's price ceilings looking...off. For more on some of the Game's oddest predictions, and where the Every Index is sitting (pretty, I'd say), read Andre's update.

Read (9 minutes)

The Weekly News Roundup: Twitter Acquires Revue

in Means of Creation

This week's major passion economy news, we'd argue, is the announcement of Li's new Creator Economy course, beginning next month. But we're biased, of course, so here's what else she and Nathan cover in their latest update: Twitter's and Forbes' dips into the newsletter pool, Clubhouse's Series B and new functionality, and a media property from...a16z, a move Li says is more natural than you might think. As usual, there's more, so scroll down to stay up on the week in creation.

Read 🔒 (13 minutes)

🎧 PODCASTS 🎧

#53: Drop the 'thing'—it's cleaner & #54: Paradigms 'R' Us

Talk Therapy with Dan Shipper and Nathan Baschez

The cofounders and hosts had no shortage of stuff to talk about this week. First, they unpacked and organized the nuts, bolts and hopes of Tuesday's launch. They had a little more to discuss about their own endeavor on Friday's episode, but the meat of their chat hinged on something else: the inherent issues with framing your book's findings as earth-shattering without interacting with all the other Big Ideas in the same lane that are already kicking around. On this of all weeks, you should want a peek inside these guys' minds, and Talk Therapy is always the most surefire way to get one.

Listen to #53 (16 minutes) and #54 (15 minutes)

#9: The Proximate Causes of My Excitement

The Long Conversation with Rachel Jepsen

As promised, the write-and-chat-about-it gang was back for their first conversation of 2021, released in podcast form this week but recorded in the run-up to the Every launch. Rachel asked Dan and Nathan about the synergy between their collaborations in creativity and business, while Taylor Majewski brought a universal question about the actual act of "doing" writing to the table.

Listen (40 minutes)

Friday's Long Conversation was about reading—how the panel did it amidst 2020's myriad challenges, and how they hope to over the year to come. Check the TLC Podcast homepage on Monday for the recording!

🎥 VIDEOS 🎥

Means of Creation: Katia Ameri & Elijah Daniel

Nathan and Li welcomed two creators extraordinaire to the show this week. From the Hollywood Hills' Rocketship House, Elijah and Katia walked through the founding of their influencer/creator/startup house, using OnlyFans as a content creation platform, and holding on to the spirit of viral stunts while working on their pipeline of upcoming projects.

What’s Going On

News you might have caught or missed this week, with takes from our writers.

The Game Stops Here

"I don’t know what to tell you," began one of Matt Levine's Money Stuff entries on the retail explosion in trading. Of course, he had plenty to say in one of our favorite takes on a bonkers week. Here are a few more:

- A 19-Year GameStop Bet Pays Off

- The GameStop Saga Shows How Casino Capitalism Is Eating the World

- How Lulz Took Down Wall Street

- Keith Gill Drove the GameStop Reddit Mania. He Talked to the Journal.

There are so many knots in the web of incidents that are making up the current state of the market, or that have happened because of it: The ex-CEO of a pet food startup buying nine million shares of Gamestop stock, chiding the company for its "UNWILLINGNESS TO RAPIDLY EMBRACE THE DIGITAL ECONOMY" and receiving three board seats as a result before seeing his long position pay off to a near-mythic degree. There's Chamath Palihapitiya putting things in perspective on TV, and AOC's Twitch forum with...TheStockGuy?

That's been part of the wonder of this week: the influx of blissfully unpredictable (or maybe inevitable, actually) alliances, direct or indirect. And speaking of people connecting on social networks to talk about the thing everyone's talking about, we asked the Every writers for their sauciest stock takes:

Yiren Lu: "The diversity of people who are supporting r/wallstreetbets now is crazy. Today I talked to a securities lawyer, a startup founder, and my mom, and they were all like, 'the system is rigged.'"

Dan Shipper: "Yeah, I did not have 'Wall Street Bets unifies nation' on my 2021 bingo card."

Bryant Jefferson, on AOC's choice of platform for her panel on market regulation: "The gamer in me is giddy that this sort of thing is happening on Twitch. As much as people talk about Clubhouse, it’s only at 2M users and still isn’t open to the public. AOC seems intent on transparency. Such an important conversation happening on a closed platform is not really on-brand."

More News

- Using an Ethereum NFT to Crowdfund my Writing

- Demi Subscription Service Connects Chefs and Food Fans

- A Vine Reunion? Video Apps Clash and Byte Join Forces

- Twitch releases latest facts and figures

Tweets of the Week

Epilogue

Every had a great writeup in Business Insider detailing all of the finer points of our writer collective. Dan did his best Blue Steel in the thumbnail for the article, but we couldn't let that stand—the rigors of starting Every have, um, definitely changed his appearance:

Before starting a media company//After starting a media companyAn Invitation to Every

Not a subscriber? Intrigued by the bundle? Now would be a good time to subscribe — it’s just $20 a month for everything we offer.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!

There were some other good names here, for "Michael Lewis book title ideas": https://twitter.com/awealthofcs/status/1354472207553093633

I added "Moneytroll"

I can't believe you didn't title it "Would you like to play a $GME?"