On May 24th, Steve Jobs attempted a beheading.

In an ill-fated coup effort, Jobs tried to rally Apple insiders to depose the reigning CEO of Apple, John Sculley. The primary sin of this Pepsi marketing executive turned Macintosh monarch? Holding Jobs accountable for hitting only 10% of forecasted sales in his division and missing product deadlines. In an April board meeting, Sculley had pushed to strip Jobs of his power and, after some debate, the board consented. Beyond missing the financial forecast, the Apple founder had been a disaster as a manager, with his trademark coarseness of character causing rebellion among his peers. In short, Jobs was unable to get support from fellow Apple leaders.

Despite many in his inner circle advising against it, Jobs went for glory to try and kick Sculley out of the company. Planning to do the deed while Sculley was in China, Jobs convened an executive team meeting on May 24th. Unbeknownst to Jobs, one of the executives he confided in, a Frenchman, betrayed Jobs and told Monarch Sculley what was going to happen. He canceled his trip, appeared at the meeting, and confronted the issue head-on by calling for a vote for who the leader should be.

Sculley won the tally unanimously and Jobs left Apple entirely within 6 months.

This decision by the board is a controversial one in Silicon Valley. On one hand, Jobs’s behavior and poor performance were absolutely a fireable offense. On the other…this was Steve Jobs. Upon his return, he built the most valuable technology company of all time. He entirely altered the paradigm for how humanity interacts with computing devices. But still, his inability to deliver financial results and misunderstanding of his fellow executives’ emotions made his dismissal wholly justifiable.

So, what happened?

Jobs’s transcendent product sense blinded him to the language of power within technology companies: finance. If he had known to say to the board some version of “Q2 deliverables were only at 10% of forecast, but because of our LTV:CAC ratio and percentage of pipeline in mid-market, we should see full quota attainment by Q4,” maybe his problems wouldn’t have been so serious. And again, if he had known how to use finance to placate his peers, in particular with its relation to product roadmapping, he would be able to more directly connect his expenditures to profits. Now, these are just hypothetical numbers and scenarios, but, for better or worse, the ability to confidently discuss numbers lends credibility to an executive who would otherwise have to rely on charisma alone.

You see, working in business without knowing the language of finance is like going to Paris without speaking French. Sure, you might be able to bumble around the city, but to truly navigate it successfully you need to speak the native tongue. It allows you to talk with the citizens (departments) across the city (company).

Perhaps you have experienced something like this. You are trying to build something you know is meaningful when some VP of Finance shuts you down. Or maybe you’re talking to an investor passing on investing in your startup. In either case, their feedback to your idea is a flurry of acronyms, adjectives, and abbreviations both esoteric and stupid-sounding. Average Revenue Per User? ARPU (are-poo)? Come on. It sucks because you can’t respond effectively, and in some ways, it feels deeply embarrassing. You know you should know this stuff but haven’t ever had the chance to learn it.

Finance is not what determines a company's success (the ability to actually make and sell compelling products does that), but it is what determines the ability to gather resources to make the products. And really, if finance alone becomes the motivation, the company always fails in the end. Sculley ran Apple into the ground, almost destroying an iconic organization. Jobs, upon later reflection, didn’t hesitate to push Sculley under the bus.

“My passion has been to build an enduring company where people were motivated to make great products. Everything else was secondary. Sure, it was great to make a profit, because that was what allowed you to make great products. But the products, not the profits, were the motivation. Sculley flipped these priorities to where the goal was to make money. It’s a subtle difference, but it ends up meaning everything.”

And Jobs is right! It is hard for me to think of a company that succeeded because it had sufficiently advanced methods of cash arbitrage. However, the best companies are able to combine a killer product with a killer financial profile. Apple offloaded almost all of its manufacturing (and a portion of their R&D) to off-shore manufacturers. This allows them to treat manufacturing as a variable cost, scalable up and down. The person who made this work wasn’t even Jobs! It was Tim Cook. Coincidentally, when Jobs died Apple was valued at ~300B. Cook turned that into a monster valued at ~$2.7T. Or said another way, Cook has added 9 more Apples in market cap in the 11 years since Jobs’s death.

Jobs is worthy of praise for what he did, but Cook did something equally spectacular—and he did it with finance.

Finance is the language you need to know to play the game of business

Over the last 18 months of writing in public, I’ve been circling around an idea like a shark with a whiff of blood in its nose. Something that feels radical and true:

Finance is the practice of narrative, not numbers. By using finance to tell the story of your company, you win at the game of business.

Financial metrics exist for the purpose of telling the story of a group’s outcomes. It is business complexity abstracted into a standard set of numbers that allows for easy comparison. The thing that matters isn’t even what is currently on the spreadsheet, it’s how the current performance compares across time and similar businesses.

In other words, capitalism is the grand game that we are all engaged in. Our time and our energy are directed by the rules of this competition. Learning finance is learning the rulebook. Sure, you can play Monopoly without understanding all the rules, but if you want to win, you need to understand the underlying math.

When I first started learning about finance, I thought that I would be doing a ton of complex arithmetic. To my surprise, the math is stupid simple. The most advanced thing you’ll probably do in finance is multiplication. The tricky part of finance is comprehending the numbers.

To speak the language of finance you have to have two distinct skills:

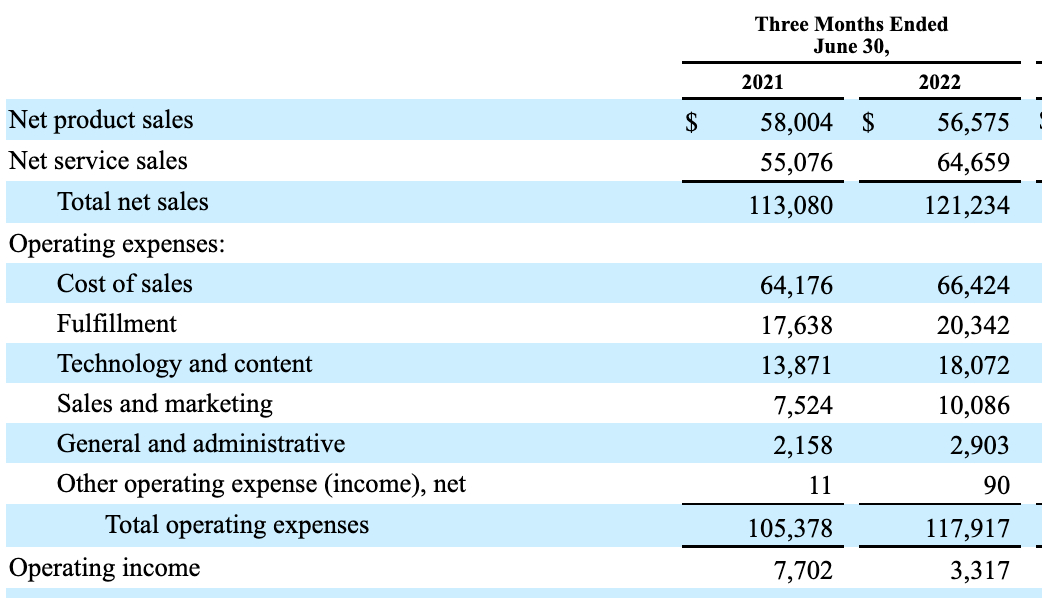

An understanding of the fundamentals: This is the boring stuff that everyone quits before they finish. Understanding the definition of revenue, what cash flow means, etc. It is a whole set of terms and concepts that are so dull that you pay me hundreds of dollars to explain it to you in an entertaining way. (Thanks for that, by the way). Think of these things as the rows on financial spreadsheets. You just need to know what each row signifies.

Comparing these rows: This is when the storytelling starts. You combine the numbers using financial ratios, forecast them into the future with assumptions, or highlight the differences between organizations. Looking at numbers in isolation is dull!. Who cares about spreadsheets? Realizing that the numbers above represent the collective output of over a million people, all organized under one organization, while delivering tens of millions of packages? That is exciting!

Product people always view themselves as artists, builders, creators, elevated above the fray of numbers. Mostly they feel this way because they never made it past level 1. Because of this, there are stories everywhere about how these special founders get kicked out of their own companies.

Once you see how to combine and forecast these numbers, you can learn how to make your projects justify investment or argue why things should be funded or why they shouldn’t. Analyzing financial documents isn’t a matter of reading; it is a matter of remixing. It’s like the English language: you can combine words to tell any story you want. Learn the grammar, tell the story. Learn the income statement, get the investment.

Understanding the language of finance doesn’t just help you communicate ideas more powerfully, it’s also a tool that helps you come up with better ideas. For all of Jobs’s genius, he would never have even considered a lot of the ideas Tim Cook brought to the table. Some ideas are about understanding what customers want, and those are clearly most important! But other ideas are about finding more efficient and profitable ways of giving it to them—areas where the business can do better without sacrificing the customer much if at all.

The problem is when a company doesn’t know how to balance the two:

All product and no finance and you get Peloton.

All finance and no product and you get something terrible like an insurance company.

Course time!

If you are interested in learning these skills and how to apply them, I am launching a course to help do just that.

- Curriculum: We will bridge the theoretical and the practical with an overview of the income statement, the balance sheet, and the cash flow statement. From there we will discuss other metrics used (LTV/CAC, Rule of 40, etc) to evaluate technology companies, and finally we will review valuation methods. The goal isn’t that you will be able to do your own accounting or even to run your finance function, but it will give you enough knowledge to be dangerous.

- Method: Each class will start off with a brief lecture by me, followed by a Q&A and then we will break into small groups to discuss case studies. We’ll have a surprise guest or two, people who I consider experts in the topics we will be discussing.

- Size: ~30 students will be accepted based on interest and fit.

- Timing: This will start Friday, October 7th with each class being down at 12PM EST for the next 5 weeks. Each class should last roughly an hour.

- Price: Introductory price of $1500 for paying Every subscribers. It is $1700 for non-subscribers and includes a one year subscription to the bundle’s writing. I will be raising the cost next time we do this class, so act fast if this price is compelling to ya.

If you are interested in reserving your spot, click HERE to put down an $80 deposit. We will have more interest than we have spots so it will go in order of first come, first served. All those not accepted will have their money refunded.

I’m incredibly excited about this! The thing that will be most interesting isn’t the knowledge, it’ll be the connections from the class. I’ve already had interest from investors in top venture funds, VPs at Meta, SWE at Google, and crypto people who…well I don’t really understand how titles work in crypto projects but they look impressive! The goal is that everyone will chip in and dive deep into finance together.

As a bonus, I’ll also hold office hours with students if there is something you want to discuss more in-depth 1<>1.

Thanks for trusting me and reading my work—can’t believe I have this job. Feel free to respond to this email if you have any questions.

-e

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!

Loved the perspective in the article agreeing with most of it except for the claim Cook did something "equally" spectacular with finance. The momentum Cook successfully created is because of the 1999-2011 era of Apple full of innovation. It's almost like innovation vs. optimization in which I'd always favor innovation. Steve Jobs actually has a great interview on this (https://www.youtube.com/watch?v=OzZB5pZTslE&t=745s&ab_channel=SirMix-A-LotRareMusic) and Apple is ironically turning into a company that it cannot truly innovate anymore other than the incremental products we keep seeing in the years.

@evan Would you consider making the recordings available, even if paid, for those that can't attend in realtime?

When is the course launching?