Sponsored By: NanoVMS

This article is brought to you by NanoVMS, a deep-tech startup based in San Francisco looking for investors.

To purchase Twitter, Elon loaded the company with over $13B in debt. That means he has to increase Twitter’s cash flow—fast. The company will be paying $1B a year just in interest payments. One of many problems is that the company only did $632M in operating cash flow last year and has averaged roughly $1B over the last five years in yearly operating cash flows. Meaning that Elon will have to increase Twitter’s last year’s cash flow by roughly $380M just to cover the costs of the loans. Add in all the other costs of running Twitter and the company is in a tough financial spot. They need to scale revenue, increase productive investment, and simultaneously decrease costs. Typically in finance you can only pick two of those.

Elon has two levers to turn Twitter into the cash machine he needs it to be in order to service his debt payments. He can raise advertising revenue or add a subscription component to the business. Unfortunately, both of these are bad options.

Twitter's advertising machine is broken and unsalvageable because of Elon’s brand risk and the inability to build a direct response platform. Subscriptions will only serve to disincentivize creator behavior and thus will make the product worse. Even if he does figure these things out, the elephant in the room is that the dominant social paradigm has shifted to video.

To alleviate these problems, Twitter needs to reinvent what it means to be a consumer internet company. The company should use its interest graph to build an algorithmic marketplace that allows outside parties to change the content format and engagement modalities.

I get it—I’m just as tired as you are of this story. Politicians, pundits, podcasters—everyone is trying to get their pound of Elon flesh, hoping to drive clicks to their website. Missing in all this chatter is a thoughtful analysis of what the problems and potential resolutions are. But this is a company worthy of serious study. Twitter is a perfect case study of the shifting power dynamics of the ad market and how to make money in this era of the internet.

Alter the product paradigm

Twitter is a special place because you can have porn, a note about policy from the president of the United States, and a highlight from last night’s World Series game all in a row, in one browser. There isn’t anything else quite like it—especially because Twitter stopped making great products in 2013.

NanoVMs has opened its latest fundraising round to the public through a reg CF. Their new OS based on unikernel tech runs cloud workloads up to 300% faster and deals with cybersecurity issues through a hacker’s eyes.

NanoVMs has revenue from 11 countries, 4 patents issued, 3 more filed and 4 grants awarded from the NSF, US Air force, and Dept. of Energy. NanoVMs existing investors include Initialized Capital, Joe Montana’s L2 Ventures, Bloomberg Beta, and Ron Gula from Gula Tech Ventures. They've also entered the US Air Force's ABMS pipeline with a $950M ceiling ID/IQ contract.

On March 21, 2006, Jack Dorsey sent the very first tweet informing the world he was "just setting up my twttr." (This same tweet sold as an NFT for $2.9M at the height of the crypto craze.) The product started with social updates, with many early users letting people know what they were up to. Over time users started to share news and events as they happened, often using Twitter as a live-blogging platform. In 2007 the hashtag, which allowed for users to easily follow specific events or topics, was created. The company tried various experiments, but all were focused on the text format. It wasn’t until their IPO in 2013 that native photos and videos were added to the feed. At that point, they stopped launching significant new products. There were half-hearted attempts at various things (including a music product called Twitter #music in 2013 that the world has collectively forgotten about) but at its heart, Twitter has stayed the same.

The focus on text isn’t necessarily a bad thing! Prose is great for a certain subset of the population. However, the data has clearly shown that the average human prefers video. Instagram’s usage grows dramatically whenever the volume of video is increased. TikTok's dominance is largely due to its commitment to short-form video. YouTube launched its TikTok clone, Shorts, two years ago and already has 1.5B users. In short: people love video, and Twitter has failed to adapt. This is a massive problem for their growth. They have likely hit the local maxima of their product paradigm. They’ll be able to add incremental growth, but their hockey stick days are far behind them.

In response, Elon will be tempted to build a video product.“ We need to contort to this consumer shift and relaunch Vine!” (In fact, they already told engineers to start building it three days ago). This is a mistake. Can they really do it better than Meta, TikTok, or YouTube? Why does Twitter have a unique right to win this market?

There is a bigger opportunity than mere catch-up.

Bill Gates defined a platform as the following: “A platform is when the economic value of everybody that uses it exceeds the value of the company that creates it.” Typically a platform company will attempt to capture the value created on its platform via revenue tax (as Apple does), but there is always a quantifiable activity that the platform take rate is based on. What is compelling and so challenging about Twitter’s text paradigm is that all of the value from the platform is soft power. All of the good stuff that results from Twitter usage happens outside of the website. Authors will tweet about their books that consumers then go purchase on Amazon. I’ll publish a tweet about my recent article that readers will pay to read on our website. Readers will then email me asking to meet which I can turn into additional opportunities. More abstractly, politicians will tweet about issues that get people going and then translate that energy into votes.

The monetization opportunities resulting directly from text are subpar. Being a text media company has been a bad business since the internet got started. But the opportunity resulting from those words is significant.

Rather than trying to be a fast follower of other consumer internet companies' products, the company needs to play a different game. This product improvement is necessitated by the changes in consumer behavior but it is also because existing monetization options are so broken.

The ad experience will never improve

Twitter’s business is about 85% brand advertising and 15% direct response advertising. Brand advertising is when a company can’t directly attribute consumer behavior in response to the ad. Think car commercials at the Superbowl. Direct response is when a company can track user behavior—e.g., they clicked on a sneaker ad and made a purchase. Both of these businesses stand at risk of fundamental collapse.

Direct response: A decade after their competitors, this year the company finally built sufficient infrastructure to run a direct response advertising business. For the first time, companies will be able to figure out if they are running an ROI-positive campaign on Twitter’s service. This is the product that propelled Facebook to a trillion-dollar valuation. In a cruel twist of fate, Twitter’s launch coincides with Apple’s decision to kneecap the entire direct response ad industry.

Apple’s App Tracking Transparency update made it much harder for companies to track a user as they moved around the internet. Other companies are getting around these rules through clever uses of AI and first-party data, but the level of investment required to get Twitter’s infrastructure to be capable of doing that would likely cost billions. I’m skeptical of this avenue of growth.

Brand advertising is a good business that is put at risk by Elon’s involvement. If you’re less concerned about direct ROI measurement, Twitter is as good a place as any to park some marketing budget. In my discussion with large ad buyers, they’ll typically put some money on Twitter “just to cover all their bases” but won’t commit huge sums of capital. Brand ads are partially driven by the macroeconomic environment, so I would expect some downward pressure on this business line with the current state of the world’s affairs.

Brand ads are driven by the popular zeitgeist. Measurement is dictated more by vibe than spreadsheet. Ad teams will cultivate long-term relationships with mega-corporations to help them launch custom events for their platform. You may love Elon, you may hate him, but we can all agree that he is a divisive figure. Ad buyers are going to be driven by headlines and narrative (remember, there isn’t concrete data on brand ad performance), so when advertisers see stuff like Elon tweeting about potential conspiracy theories, they get nervous. Already brands are pausing their spending on Elon’s Twitter. The more Twitter embraces a stance as the “free-speech” platform, the more perceived brand risk major advertisers will see. The best brand ad platform is vanilla ice cream sprinkled with tapioca and mayo—i.e., bland. Elon’s involvement pretty much nukes that option.

Poor ad performance is also due to the engagement modality. The best ads are the ones that are surfaced when the consumer has high intent toward a purchase decision. Amazon’s ad business is growing faster than Google’s or Facebook’s and did $9.5B last quarter because the ad surfaced exactly when the consumer is looking to make a purchase. Twitter doesn’t have a high-intent engagement use case. People are scrolling for information, not for shopping. The feed makes the product far less performative for advertisers.

You could probably fix all of these brand issues with competent management, but Twitter’s ad sales chief and sales VP have both quit since Elon took over. I don’t foresee a quick fix.

So if not ads, maybe subscriptions?

Subscriptions are tough too

Spoiler: probably not.

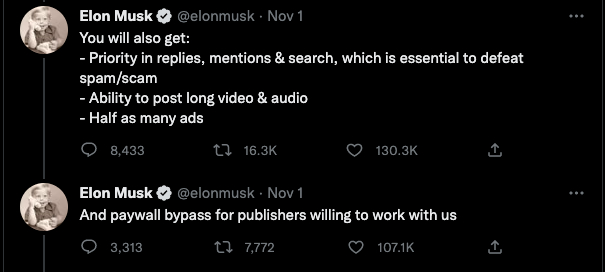

The most concrete news we’ve had out of the Twitter war room is the launch of Twitter Blue at eight bucks a month. The features include verification and the following:

All of those sound great! They also sound like they should be free!

Social media is a beautiful business model because, when it functions correctly, it should be a virtuous content creation cycle. As the product gets better, you spend more time on it, so you’re served more ads, the company makes more money to invest in making the product better, which makes you spend more time on the service… continue forever.

By paywalling all the features that would make the central feed a better experience, Twitter will decrease engagement, even further reduce the efficacy of its ads, and slow down its growth. Not great for a business struggling with ad sales and user growth.

One could potentially argue that the company needs to break away from the ad model from an ethical perspective? But you can’t repay loan providers with moral superiority bucks.

I could be completely wrong, and lots of people may sign up for this product, which would help pay the bills. If we give them a generous 250M (roughly in line with public numbers) daily active users, a reasonable 2% conversion rate, and absolutely no churn, Twitter Blue can be a $480M a year revenue line. It’s nothing to sneeze at, but it’s far short of what is needed to dramatically alter the future of the business. Keep in mind that this revenue line will likely sacrifice future user growth in favor of revenue today.

Twitter is also offering to paywall certain pieces of content. A user can post three photos and then paywall a fourth photo or video. The most obvious implication of this is a proliferation of adult content, which can be a great way to make money. OnlyFans did about $1B in income last year, and Twitter would easily be a superior offering because it would offer demand aggregation in contrast to OnlyFans not having a native social network. But this isn’t a new strategy. Twitter acquired Revue to compete with Substack, and in all my conversations with newsletter writers, I’ve never met anyone who uses Revue. The company hasn’t shown an ability to build a good subscription product.

Even if they do launch an OnlyFans competitor, this once again kills the golden goose of brand ads. No company is going to want to sell their detergent on a site primarily known for sexy step-moms stuck in laundry machines.

A more promising version of subscriptions is a toolset for companies. This playbook is more established: lightweight customer management software paid DMs that appear at the top of targeted customer inboxes, assistance for brands to manage password permissions—all stuff that has been built a hundred times over. This is a good product and would help juice revenue to cover interest payments.

But once again, this doesn’t solve the fundamental problem with the platform. An algorithmically sorted text-heavy feed just isn’t something most people want.

Enough whining. How would you fix it?

The company needs to simultaneously:

- Counter-position the platform against the video trends of other social platforms.

- Retain advertisers.

- Find revenue streams that don’t kill the user content creation flywheel.

The key is to reimagine the feed.

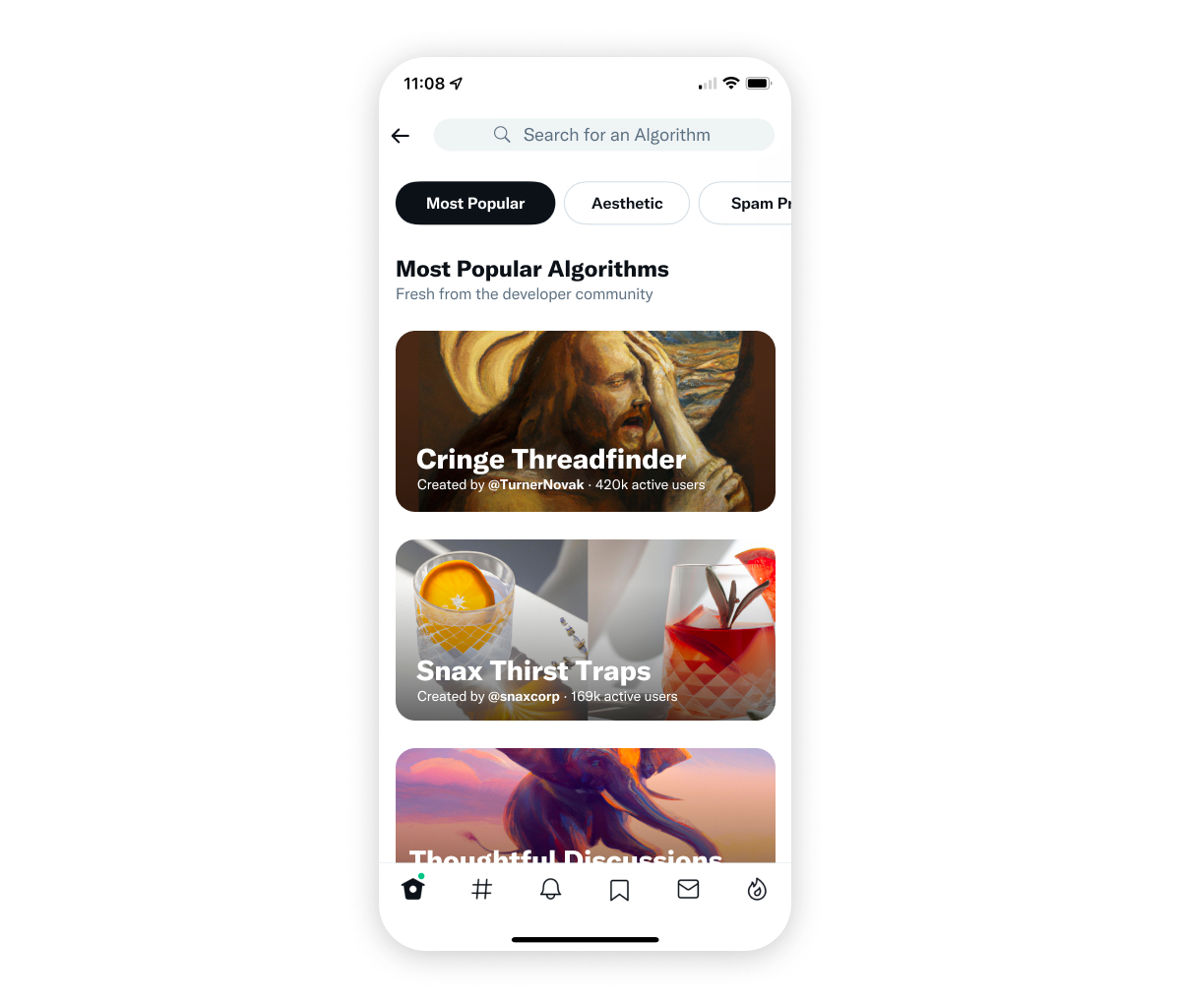

A user's feed is currently determined by one central algorithm. Twitter should allow for a competitive algorithms marketplace. My colleague Nathan sketched out what it could look like.

Imagine a world where you could reorder your feed by influencers or topics. Algorithmic developers would be compensated by ad revenue share, and engagement should skyrocket by virtue of free market competition. Another version of this idea is Ben Thompson’s identity protocol, where they separate the company into two parts: one that holds the identity of users with APIs the developers can build on top of and one that sells ads.

My suggestion combines the two.

Twitter should be one company that allows for an algorithmic marketplace that also allows for changes to content format. Twitter would become an identity layer to a custom internet. There would be a persistent user identity, ideally, with credit card and shipping information attached, that could be ported from information feed to information feed.

To help scale these developers’ businesses, Twitter could also build out its ad stack to fix the problem. Developers would get access to an API identity and ad stack to increase monetization. Want to build an in-app TikTok? Sure. Want to build a browsing experience a la Pinterest? That works. Some of the most difficult issues of scaling a user-generated content platform—a critical mass of users, moderation, monetization—would already be solved for prospective developers. You would be able to keep the text-heavy paradigm of yesteryear for historical power users while simultaneously building new versions of Twitter to acquire customers. Avoiding Thompson’s two-company route allows for tighter control of brand safety—a necessity for advertisers.

Additionally, this would allow for more value-capture modalities for text. Imagine if Every made a custom Twitter feed with our articles along with thoughts from our writers. Twitter would provide demand aggregation, for which we would happily give them a cut of our revenue. It could be like mixing Slack, Discord, an email inbox, and Twitter feed all at once. Twitter could move from the soft layer of media to the technical layer as it becomes something like a lightweight content management system a la Wordpress that is also able to funnel 250M users towards your publication.

There could be similar feeds for companies building shopping experiences of retail goods, which would benefit the direct response ad business. Because all purchase behavior would happen in-app, the direct response business would boom. Imagine if all the brands you follow were amalgamated into a custom shopping view with one-click checkout. It wouldn’t even be technically difficult, as you could probably build this with a deep integration with Shopify.

There have been elements of this idea tried before. Facebook has been flirting with it since the early 2010s, when “the social internet” meant that your friends’ transactions would appear in your newsfeed. In ancient internet times, Yahoo tried to do this with Geocities (and failed miserably), and in modern times Reddit has half-heartedly tried this (and failed lightly). Twitter should go all in on it. All they have to lose is $44B.

If you listen to the interviews with people who are currently in the war room of Twitter, they usually list Elon’s primary concerns as loosening up content moderation and bots. While those things are annoying, they aren’t what are holding the company back: it’s the feed.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!

Really good analysis Evan!

How do you think a "reimagined feed" would incentivize creator behavior?

What so many creators love about Twitter is all the value they're capturing there.