Sponsored By: Uptrends.ai

This essay is brought to you by Uptrends.ai, it's like Google Trends and Wall Street merged into one powerful tool. Get 50% off for your first 3 months by entering the code EVERY50 when you sign-up and jumpstart your financial journey.

Currently, our platform is exclusive to desktop users. So, pull up your chair, log in from your desktop and start leveraging the power of Uptrends.ai to stay a step ahead in the market.

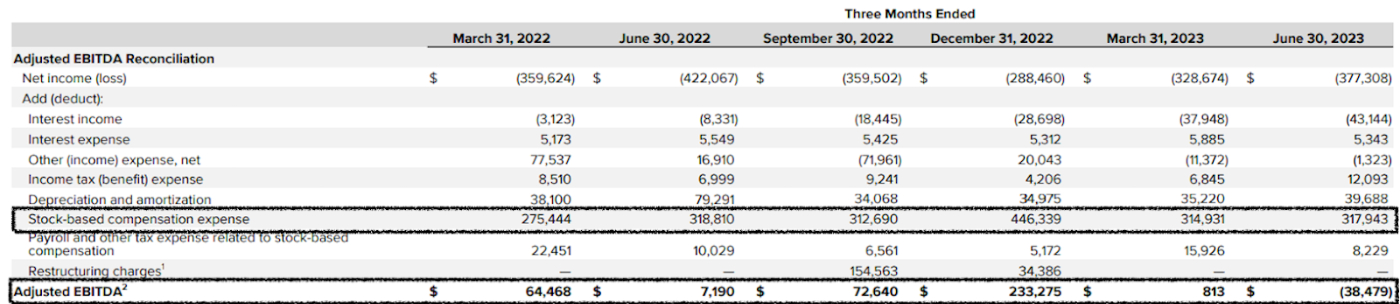

When Snap’s Q2 earnings came out earlier this week, the stock immediately dropped 17%. The company had a 22% jump in infrastructure costs, its revenue was down 4% year over year, and it’s spending $317M a quarter on stock-based compensation.

How did it come to this? In the last year the company has launched GenerativeAI products and a new subscription product, the latter of which has 4M users. The much-predicted recession hasn’t materialized. These are all things that should supposedly make this business hum. Instead, the results were the lovesong of a cat with tinnitus (abysmal, off pitch, very bad).

The answer to the consistent underperformance is simple. The company has failed to address all of the things that were broken a year ago—and the year before that and the year before that and the year before that.

364 days ago I published a piece arguing that “Snapchat’s Probably Screwed.” Today is a follow-up to that original post on what I got right (and wrong). I would propose the company is guilty of two primary sins:

- Using the placebo of “innovation” to hide lackluster growth

- A broken monetization model

To fix the company, there likely needs to be serious layoffs and an honest look in the mirror about what Snap can be.

Snap is an INSERT WORD THAT GIVES JUICY MULTIPLE HERE

For many years, Snap’s investor presentations started with this slide:

This makes no sense. It is like McDonald’s saying they’re a lettuce farm—picking something higher up in your value chain to define your company is nonsensical. Spectacles aside, Snap is not in the business of producing cameras—it sells ads. The company released an updated version on December 13, 2022:

This… is not that much better. A more factual description would be “Snap Inc. is a bundle of messaging and entertainment services primarily delivered through an app.” However, the inaccuracy benefits the company by allowing it to spin a narrative of grand ambitions and experimentation (and justify fat compensation packages).

When it was a “camera company,” Spiegel led the organization in a fruitless exercise of hardware development. It launched its first effort, the Spectacles, with a viral marketing campaign in 2017. The device won awards and drove an internet bonanza. Great! Investors were excited. However, the fiscal result was lackluster. Snap overproduced and took a $40M loss while selling fewer than 500K units. For comparison, in 2018 Apple sold ~600K iPhones a day.

This pattern plays out again and again. Using the justification of “I am a genius and the controlling shareholder,” Spiegel has burned tons of cash for middling results.

Snap, “the technology company,” has a 10-year history of buying or launching expensive projects that produce completely linear growth. It even proudly displays it! The company has had some version of this slide for years, too. Here is the Q2 2023 edition:

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!