When an eCommerce business starts making more money, it costs more money to run. Consider an apparel business that sells athleisure. A pair of joggers might retail on the company’s website for $100 and cost them $40 to manufacture and ship. The gross margin on the joggers is $60 (60%), leaving that amount for all of the non-unit expenses like corporate salaries, rent & utilities and marketing.

That all makes good sense. But what if you want to start this apparel company from scratch? You would need to pay the manufacturer for those joggers before you sold them to your customers. The income statement describes the profitability of a company, but it doesn’t describe the cash dynamics.

A cash conversion cycle (CCC) is the amount of time it takes for a company to return the cash investment in inventory back to the company. CCC is important because it bridges the gap between profitability and cash flow. A high, positive CCC means that your cash is held up longer in inventory. A negative CCC means the opposite: your suppliers are financing your business for you. At zero interest. It’s highly preferable to have a negative CCC, but it’s hard to do!

In this piece, we’re going to look at the formula for calculating CCC, and go through examples from eCommerce IPOs and startups that demonstrate how to improve CCC—and what to avoid.

Income Statement <> Cash Flow Statement

Before we get into the details of the CCC, why do we use the income statement at all? The cash conversion cycle (and related metrics) doesn’t appear on the income statement. This is because it’s not related to the profitability of the company. This is intuitive at a small scale—you must buy the inventory before you get the cash from the sale to your customer.

Financial statements are prepared for management, investors, lenders and other parties to make decisions about the business. There are two unique ideas here: the profitability of a company (revenue less expenses) and the financing relationship with their suppliers and customers.

While cash flow is most important, the income statement is also very useful. You could imagine a situation where the limitations of an income statement are actually worth it. It doesn’t make sense for a company to buy $40 of inventory in March, show a $40 loss, then sell that inventory in April for $100 and show a $100 profit. Even though that’s what happens to the cash, investors want those numbers tied together in one time period to evaluate the prospects of the business. That’s the benefit of the income statement.

Cash Conversion Cycle Formula

To measure the quantitative impact of this dynamic, companies track their cash conversion cycle. The CCC tracks the number of days it takes for a company to return it’s investment in inventory back to themselves. Here is the formula:

Days of Inventory Outstanding

+

Days Sales Outstanding

-

Days Payable Outstanding

=

Cash Conversion Cycle

Days of Inventory Outstanding (DIO) is the time it takes between when a company buys inventory and when they sell it. If a company’s DIO declines from 20 days to 15 days, that means that the company is selling inventory five days faster. They used to buy on the first of the month and sell it by the 20th, now they buy on the first and sell on the 15th.

Formula: (Average Inventory / Cost of Goods Sold) * 365

Cash Impact: An increase in DIO is a decrease in cash; a decrease in DIO is an increase in cash.

Days Sales Outstanding (DSO) is the time it takes before receivables are collected. As an example, an original equipment manufacturer (OEM) like YKK (which manufactures zippers) might sell 10,000 units to an apparel company that makes joggers. These transactions are often bought on credit and invoiced, with terms to pay the supplier afterwards. A common payment term is Net 30—meaning the buyer has 30 days to pay the supplier. However long it takes, the number of days where the buyer has the goods but hasn’t paid the supplier yet is called Days Sales Outstanding.

Formula: (Average Accounts Receivables / Credit Sales) * 365

Cash Impact: An increase in DSO is a decrease in cash; a decrease in DSO is an increase in cash.

Days Payable Outstanding (DPO) is the opposite of DSO—it’s the number of days it takes for a company to pay its own bills and invoices to its creditors. In that same example, YKK might buy chemicals and plastics to make their zippers. The amount of days between when YKK gets the supplies and when YKK actually pays their supplier is their DPO.

Formula: (Average Accounts Payables / COGS) * 365

Cash Impact: An increase in DPO is an increase in cash; a decrease in DPO is a decrease in cash.

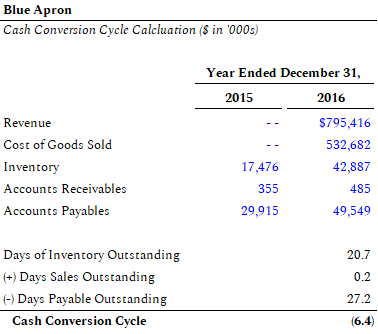

Example Calculation - Blue Apron

So, if we wanted to calculate a company’s CCC from scratch, we would need the following metrics:

- Revenue

- Cost of Goods Sold

- Previous Year Inventory

- Current Year Inventory

- Previous Year Accounts Receivables

- Current Year Accounts Receivables

- Previous Year Accounts Payables

- Current Year Accounts Payables

To show how we would find this data, I’m going to use Blue Apron’s Form S-1 as an example (we are going to use fiscal year 2016 for simplicity).

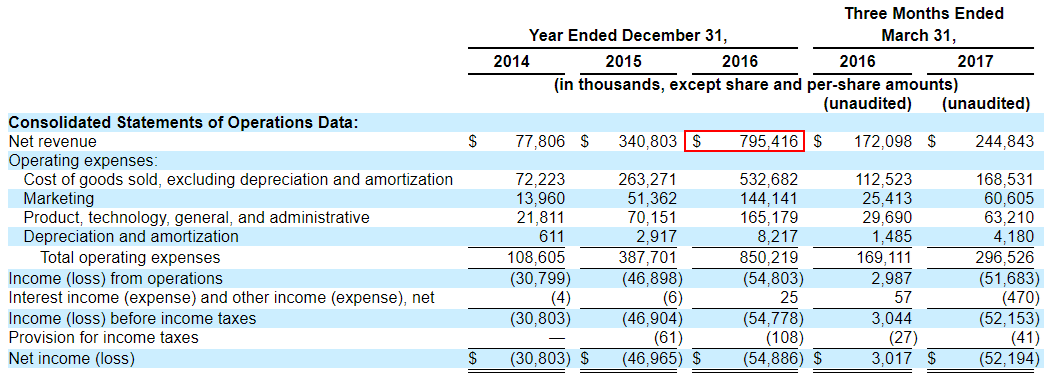

Revenue: $795,416,000 (Page 13)

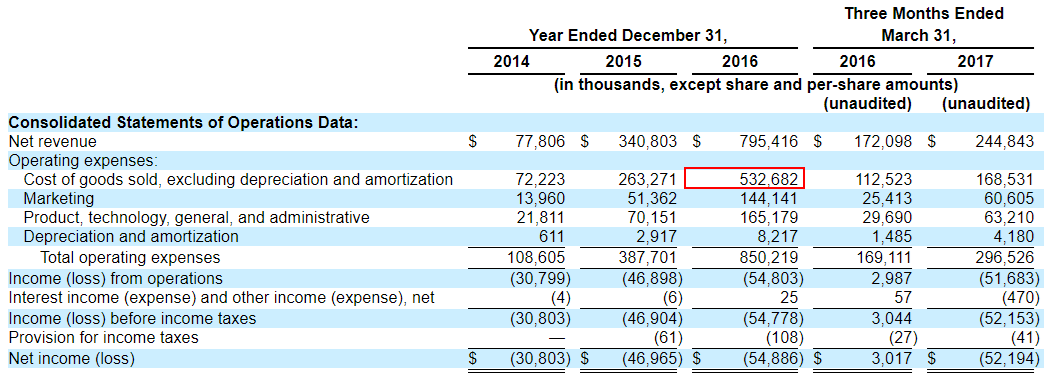

Cost of Goods Sold: $532,682,000 (Page 13)

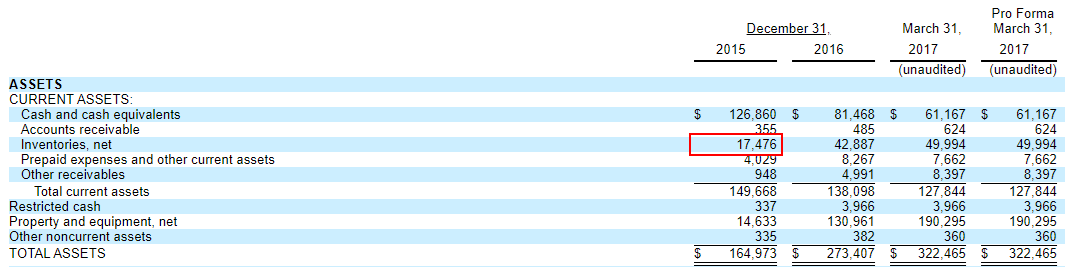

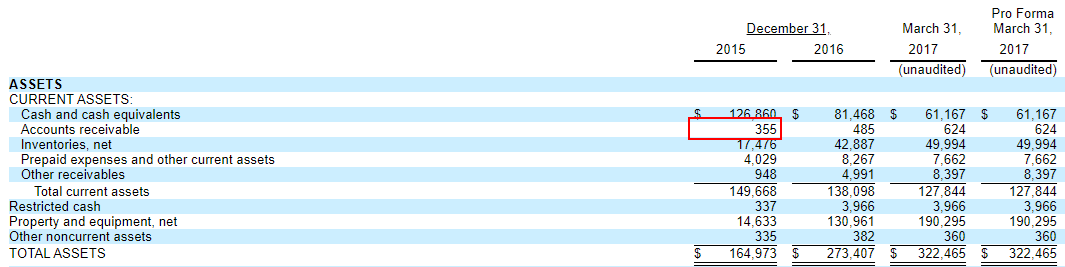

Previous Year Inventory: $17,476,000 (Page F-3)

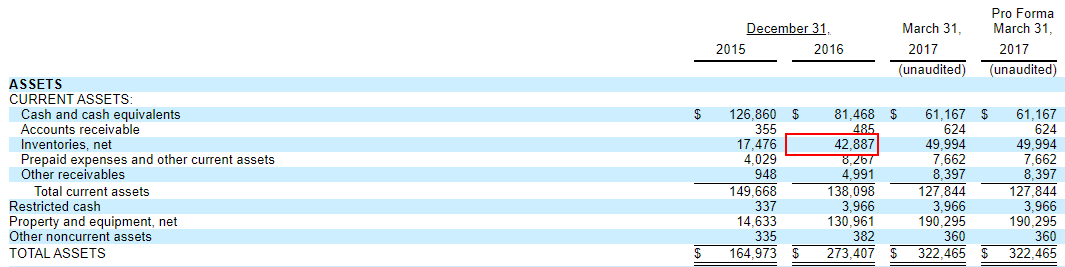

Current Year Inventory: $42,887,000 (Page F-3)

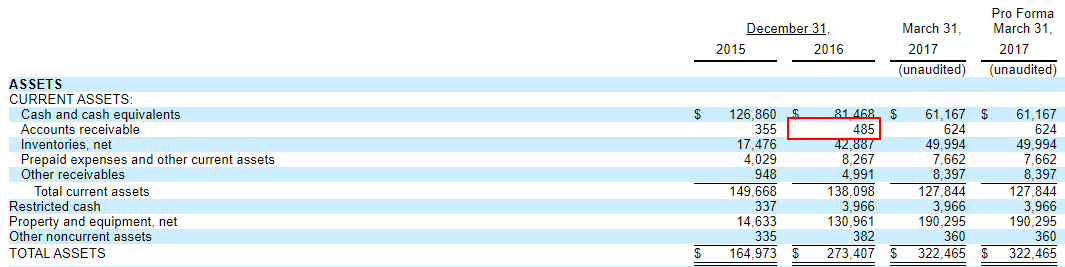

Previous Year Accounts Receivables: $355,000 (Page F-3)

Current Year Accounts Receivables: $485,000 (Page F-3)

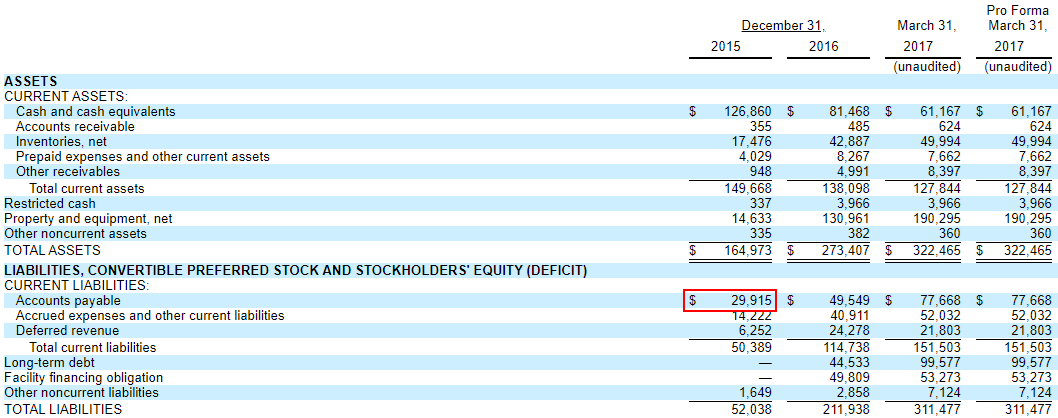

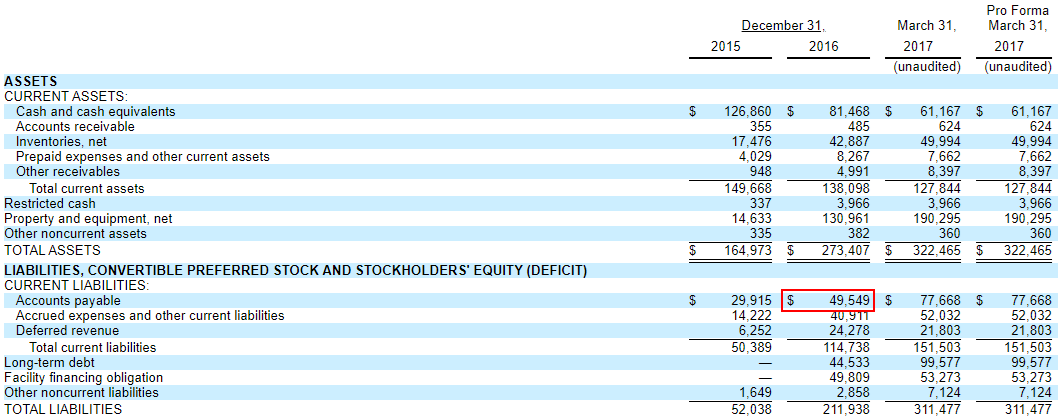

Previous Year Accounts Payables: $29,915,000 (Page F-3)

Current Year Accounts Payables: $49,549,000 (Page F-3)

Next, we take this data and plug it back into our formulas.

In this case we can see that Blue Apron had a cash conversion cycle of negative 6.4 days.

Public Retail IPOs

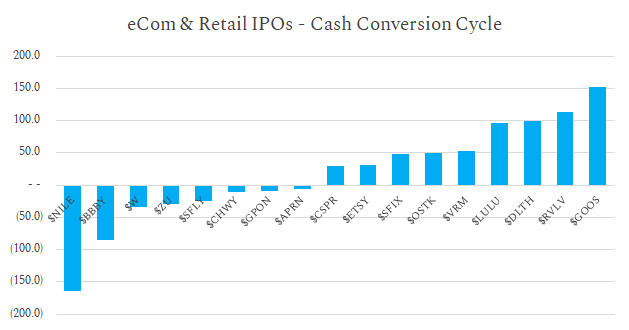

One interesting way to understand the dynamics of cash conversion cycles is to look at the metric across various types of retail companies.

Below I compiled the CCC of 17 eCommerce and retail companies at the time of their IPO. As you can see, there’s a wide range: the lowest being negative 163.8 (Blue Nile) and the highest being 152.5 (Canada Goose). Let’s dive into a few of them to understand the mechanics.

(Source: Company Form S-1s)

Blue Nile ($NILE): -163.8. Important Factor: Supplier Relations

Online engagement ring retailer Blue Nile set up their operation to have positive cash flow dynamics. While their main value proposition to customers is the 20-40% discount on diamonds and jewelry, they have a very strong relationship with more than fifty suppliers. Blue Nile doesn’t procure diamonds from their supplier until a customer pays for them, and due to long-term contracts, Blue Nile doesn’t have to pay their suppliers for 30-120 (or more) days. At the time of their IPO, Blue Nile had a Days Payable Outstanding of 261.0, which is what makes their CCC so low. Read more.

Wayfair ($W): -84.3. Important Factor: Low Inventory

Wayfair is one of the largest home goods eCommerce players and competes by having great merchandising and one of the largest online selections of goods on the internet. The trick to their negative CCC is their inventory management. Wayfair utilizes an asset-light strategy where over 90% of their items are shipped directly from the manufacturer to the customer. This allows Wayfair to carry very low levels of inventory, thus reducing their cash burden. At 6.0 days, Wayfair has the second-lowest Days of Inventory Outstanding of any of the companies we analyzed. Read more.

Canada Goose ($GOOS): 152.5. Important Factor: High Inventory

Canada Goose sells high-end (“Extreme Weather”) outerwear, mostly notably a puffy and warm parka. They had the highest Days of Inventory Outstanding of any of the companies, coming in at 233.2 days (over 7 months!). In 2019, Canada Goose had $738.7 million in sales. But, as you might expect, $345.5 million (46.7%) of those sales came in Q4 while only $54.3 million (7.3%) came in Q2. The product is heavily geared towards cold weather and it’s also popular as a gift. The reason DIO is high in these situations is that it’s harder to predict demand YoY then it is QoQ. If a company sees the demand rising every quarter (or month), it can more accurately predict the next month. But if they are expecting the demand to follow the previous season, it’s much harder, so they have to carry more inventory.

How to Improve Cash Conversion Cycle

Decreasing the cash conversion cycle is one of the best ways to improve your cash position. To dramatically change your CCC you would need to change your whole business model. But there are a couple ways to improve it incrementally.

Reduce inventory by reducing DIO

Reducing inventory is one way you can reduce your cash conversion cycle. There are several ways companies can achieve this:

- Improve demand forecasting. If your company can more effectively predict the amount of inventory that you need, it allows you to order the right amount at the right time.

- Reduce supplier lead time. The more time it takes from when you place an order to when you receive it, the more accurate your demand models have to be. By reducing supplier lead time (by reducing transportation time, or making sure your supplier has their own lead times in check), you can be more agile in ordering.

- Reduce order cycles. Smaller, more frequent ordering gives you more flexibility to adjust to fluctuating customer demand.

- Promotions and marketing. While this will hurt margins, one way to move inventory faster is to discount products. This can be especially useful with items that have declining demand.

Reduce accounts receivable by decreasing DSO

The second way you can reduce your CCC is by reducing your accounts receivable: collect money from your customers faster. With many eCommerce businesses, this one is hard to change because your customers pay with cash already.

But even for the companies with a significant amount of receivables, most of the advice for reducing this comes down to best practices like having very clear contracts and proactively following up with customers. Nonetheless, it’s still a lever you can pull.

Increase accounts payable by increasing DPO

The final way you can decrease your CCC is by increasing your accounts payable balance. This one is a bit counter intuitive: accounts payable is the amount of money you owe to suppliers. Wouldn’t you want to decrease that number, not increase it?

Let’s walk through a quick example. In Period A, you have $10 of inventory. You pay $5 in cash to suppliers right away, and pay $5 later because it’s on credit. In Period B, you still need to buy $10 of inventory, but you increase your accounts payable from $5 to $6. This means you only have to pay $4 in cash to your suppliers right away. So increasing your accounts payable actually increases your cash balance.

So how can you increase accounts payable?

Generally, there are two ways. The first involves a bunch of incremental improvements: building a better relationship with your supplier, using software to automate invoicing and payments, and being more consistent. The other way is to build negotiating power—usually by achieving scale.

Membership models

While the above three sections describe the three ways you can adjust your CCC when running a business, it’s also possible to design a business with positive cash flow dynamics in mind. And one of the best known tools to do that is through a membership model.

Membership models are a well-known mechanism for lowering the cash conversion cycle. With a normal business, the company has to pay for inventory before they sell the item. This is also true for membership models, but with one key difference. The company gets an upfront payment in exchange for a discount on the products. It’s a financing mechanism.

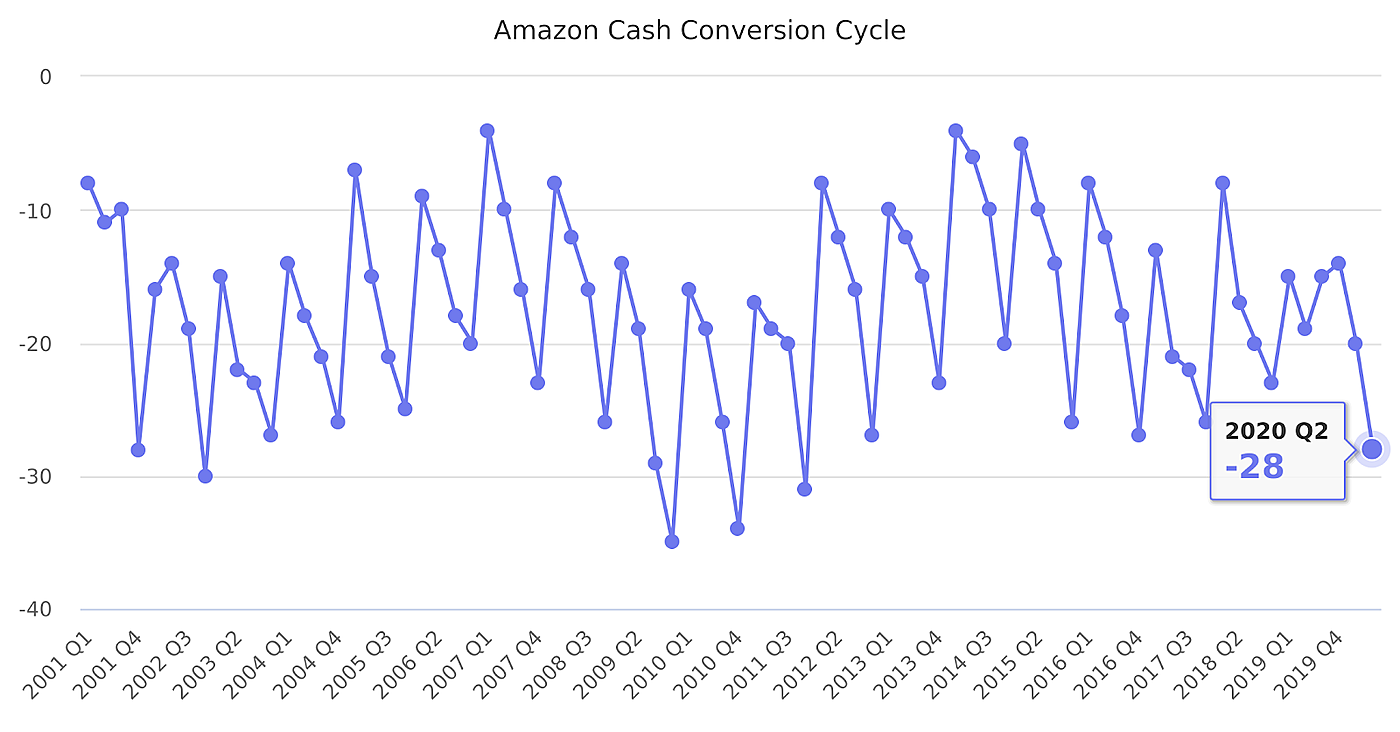

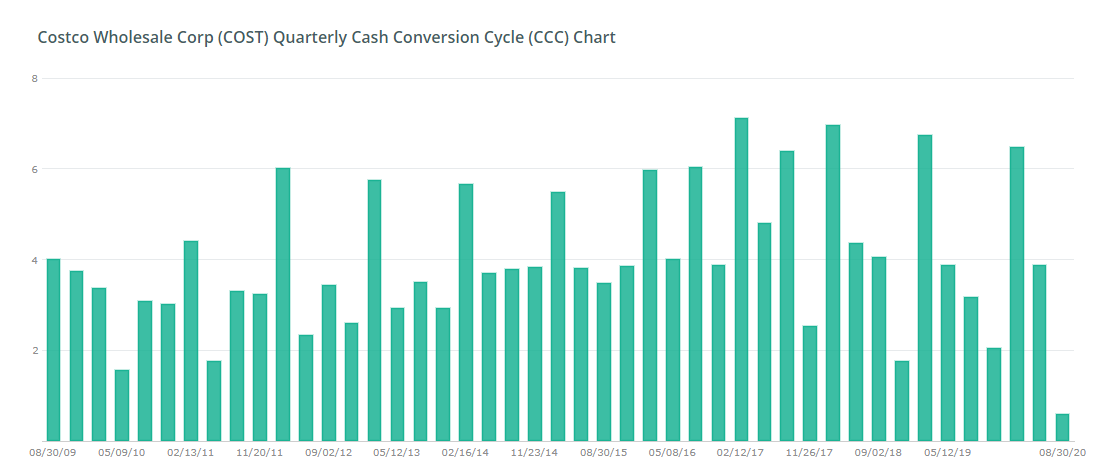

The most well-known examples of successful membership models are Amazon and Costco. Amazon is able to leverage their annual Amazon Prime Membership to drive a negative CCC. Costco also adopts a membership model and has had a CCC between 4-7 days (significantly lower than the industry average of ~80). Keep in mind that the negotiating power due to their vast scale also helps them keep a high DPO, which also helps lower their CCC.

(Source)

(Source)

So, whether you are an operator or investor, it’s always important to keep your cash conversion cycle on the top of your mind. Managing it properly is the difference between being in control of your cash position and running into liquidity problems.

Further reading:

- What startups can learn from Amazon’s cash machine // Alex Taussig

- The Power Of Having a Negative Cash Conversion Cycle // Jay Vasantharajah

How did you feel about this post?

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!