Want to sponsor Every's smart long-form essays on tech, business, and productivity?

B2B brands that partner with us are able to reach the inbox of key decision-makers in companies of all sizes, from startup founders to global executives. B2C partners are able to reach investors of all types as well as operators in the tech industry.

If you are interested in partnering with us or just want to learn more, click the link below:

When two of the traditional “big five” publishing houses—Penguin Random House (itself the result of a merger between Penguin and Random House) and Simon & Schuster—attempted to merge earlier this year, the Department of Justice sued them over antitrust concerns about two of the world's largest publishers joining forces. The DOJ’s ultimately winning argument was that the combined entity would reduce the options available to authors seeking book deals and control the market for book rights.

Buried within the DOJ's case was a reference to audiobooks: “Similarly, audio rights used to be negotiated separately but the Big Five publishers now generally demand that authors bundle audio rights with print and electronic rights.”

Audio rights—the legal (and generally exclusive) right to publish the audiobook of a particular book—used to be an afterthought. Print mattered most, ebooks were the future, and audiobooks were the weird half-brother. But now, audiobooks are all the rage, with the audiobook market having grown by double digits every year for the past decade.

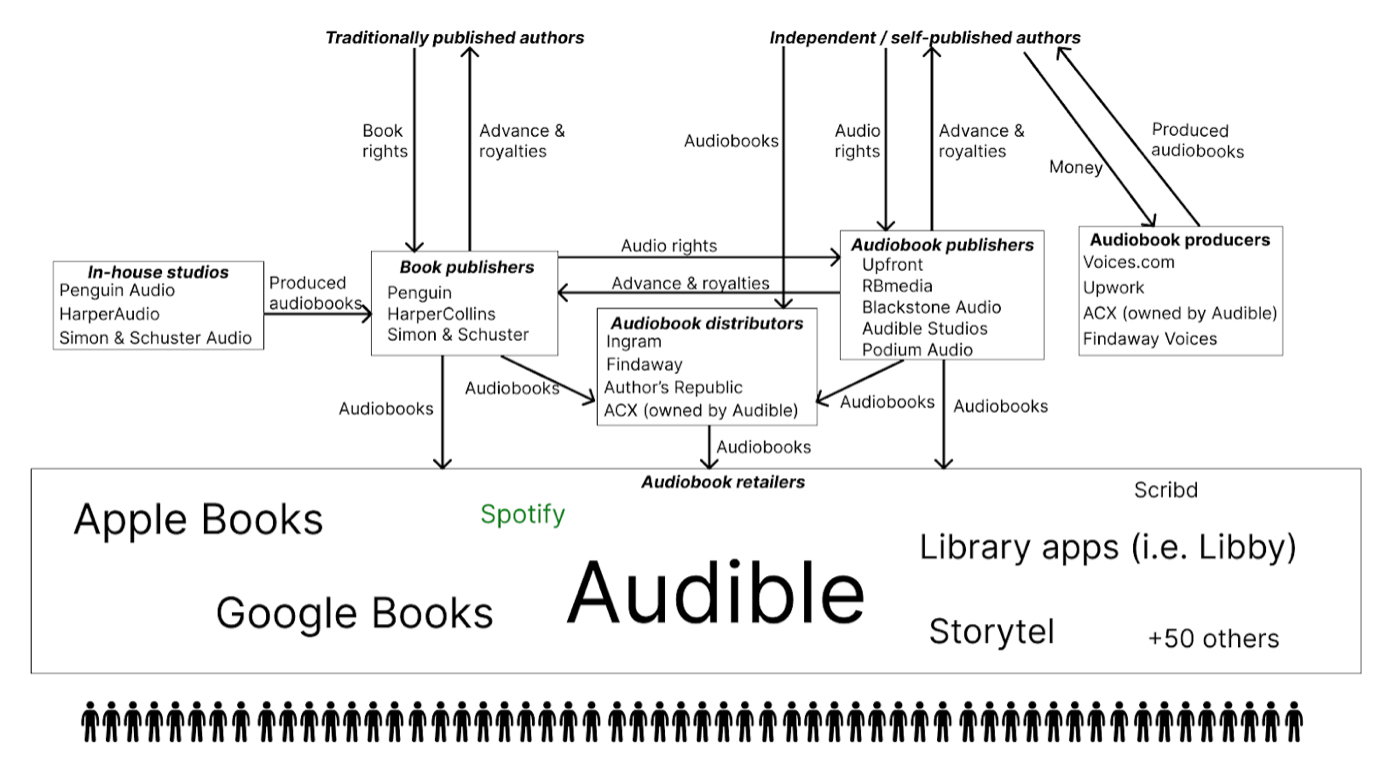

I launched audiobook publisher Upfront Books in 2019 at what may have been the tail end of the period during which it was possible to acquire audio rights from larger publishers and authors as a bootstrapped upstart. I spent a lot of time developing relationships with authors in an effort to be their audiobook publisher. But I was always reluctant to bring up the realities of the audiobook industry, which is dominated by Amazon-owned Audible. When an Audible subscriber downloads an audiobook, the publisher may only get a few dollars, depending on its deal with Audible and the list price of the audiobook. Of that amount, authors normally receive 25% as a royalty.

You may be asking yourself how that’s possible in a zero-marginal-cost digital world. Or you may be nodding your head, having already considered the power that Audible has as the strongest aggregator (by far) in this market.

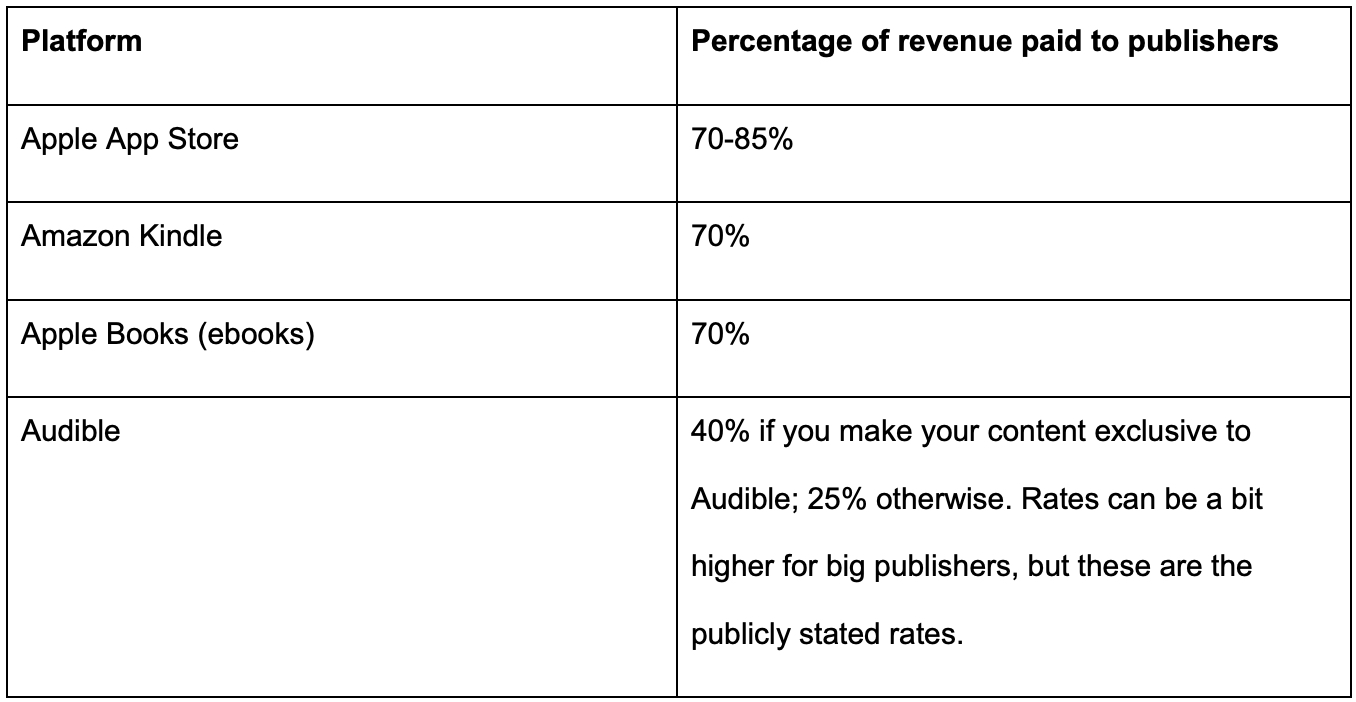

Three months ago, Spotify launched its audiobook product with a catalog of 300,000 to 400,000 audiobooks. (These are not included with a Spotify subscription. Each audiobook costs, on average, $20 or $25.) Audible’s stronghold on the market is one reason that Spotify’s entry into audiobooks is a big deal for book publishers: the company has between a 40% and 90% share of the audiobook market, depending on who you ask. Until now, there hasn’t been a viable challenger to Audible, unless you consider Apple Books and Google Books. But they haven’t made a strong push, as ebooks and audiobooks have always been just another offering for them. Publishers are surely cheering on another competitor entering the market.

To better understand Spotify’s strategy, it’s important to understand the audiobook market and how it’s changed.

It all starts with content: books written by authors who either have a book deal with a publishing house like Penguin or Simon & Schuster, or they venture off on their own and publish independently. There are three key categories of book rights:

- Print (paperback and hardcover)

- Ebook

- Audiobook

Producing an ebook is mostly a matter of putting a book into the correct file format, so publishing houses and independent authors have almost always held onto ebook rights. When the Kindle came out in 2007, everyone thought that ebooks were the future, yet its share of book sales has topped out at 10 to 15%, and even COVID couldn’t permanently change consumer behavior.

Audiobooks are different. In 2010, they made up only about 2% of the book market. Today, with five times as many smartphone users as a decade ago and in our Airpods-always-in world, audiobook sales make up nearly 10% of the book market. Sales have been growing at around 20% every year for the past few years and are projected to grow even more quickly through the rest of this decade. At the same time, production costs have come down significantly: every voice actor has their own website or advertises themselves on one of a number of voice marketplaces, and many have home studios that can produce high-quality sound.

What does this all mean? Audiobook rights used to be an afterthought for most authors and publishers. Even the largest publishers normally sold off their audiobook rights to audiobook-specific publishers. Today, audiobooks are hot and publishing houses are maintaining the audio rights to their highest potential new releases, knowing that they can derive long-term equity value from audio, especially if the market grows as expected. They’re taking this market seriously, as is Spotify.

Spotify wants to own your ears. As Evan Armstrong wrote, “[Spotify’s] goal is to leverage the giant ocean of attention commanded by its app into a giant improvement in gross margins.” In other words:

- Spotify conquered the music streaming market.

- The company leveraged its pre-existing massive audience and some smart acquisitions to become number one in podcast distribution.

- Spotify is going after the remaining large category of audio: it wants to go up against Audible and become number one in audiobooks.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!

Thanks for the write up. I have to admit, as a lover of audio books (and the convenience of Audible) I read it with a bit of sadness. Not sure if you saw Brandon Sanderson's recent announcement, but he just came out saying he would list his 4 "secret project" books on Audible. Only Speechify and Spotify for now. His reasoning cited many of the same points you made in this article.