“Tech is now a mature industry.”

It’s the first thing Hiten Shah tells me when we start our interview. But he doesn’t sound depressed about it. He’s actually excited.

“It’s like spaghetti sauce. You walk down that aisle in the store and see a ton of different brands and flavors. A lot of strategy goes into it. The tech industry is basically there.”

It makes sense. It’s never been easier to build software, so there’s more competition than ever. Every category in tech now looks like a crowded grocery store aisle.

People have options.

This, says Hiten, is why strategy is more important than ever: it’s the solution to increased competition.

But how do you come up with a good strategy for your startup? Should you study business school concepts like “the five forces” or “accumulating advantages”? Or perhaps just emulate companies like Amazon and Google?

Hiten has a different idea: focus on the inputs — the facts you observe about your market and customers that get fed into strategy frameworks.

But in order to understand that, we need to zoom out and first understand Hiten’s model for how strategy formulation even works. Then, we’ll learn where most founders go wrong, and hear his tactical advice for how to improve your strategy process.

So let’s dive in :)

Hiten introduces himself

Hi! I’m Hiten Shah. Previously I started two SaaS companies: Crazy Egg and KISSmetrics. I’ve also invested / advised over 120 companies including Buffer, Clearbit, Fountain, Front, SlideShare and Webs.

My current startup is FYI. We’re building a platform that helps you find information and see what’s happening at work, starting with your documents..

I also have an email newsletter called Product Habits where my FYI co-founder and I share product development resources, our own case studies and best practices.

How Hiten creates strategies

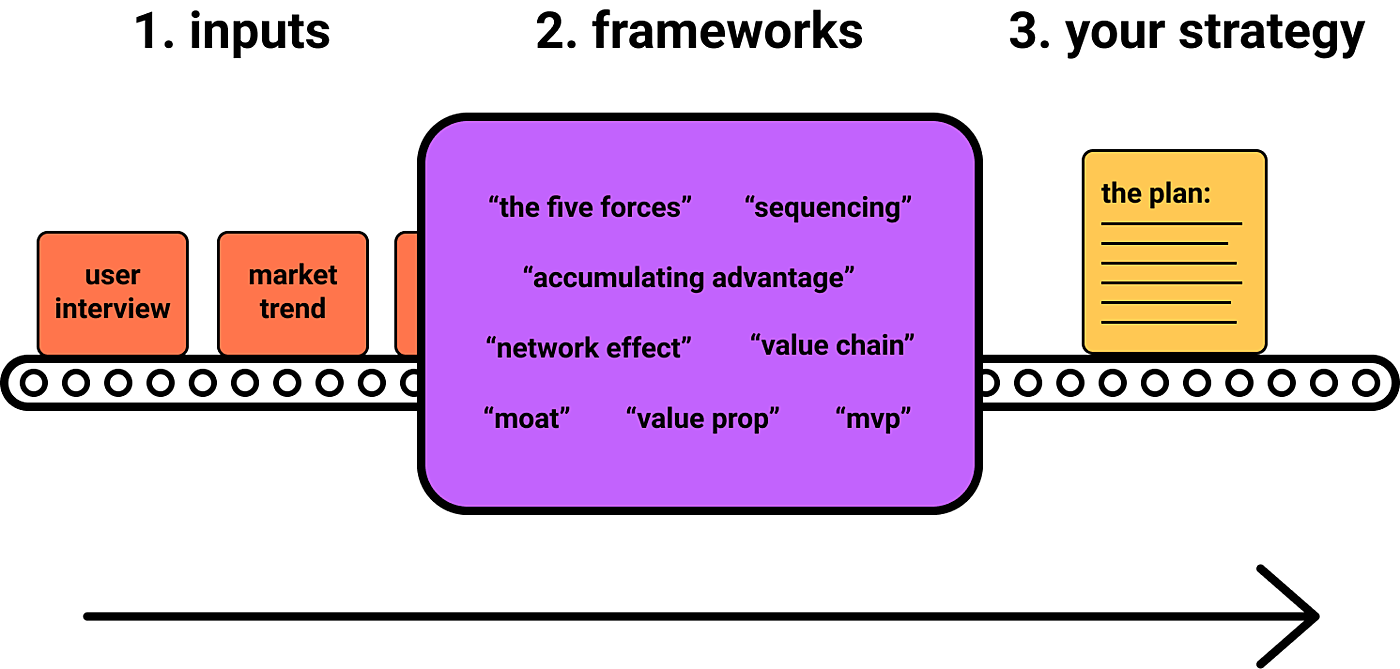

I think of strategy formulation like a machine:

It starts with inputs — observations about the market you’re in. What are customers saying? What companies are succeeding? What trends are happening?

Then, you run those inputs through strategy frameworks that you can learn in books, in business school, or from mentors. These are ideas like “the five forces” and “moats” and “flywheels” that help you make sense of all the raw inputs.

The result you get from running inputs through your frameworks, the output of the machine, is your company strategy.

This can take the shape of something formal, like a document that outlines how your company is going to operate. But it’s also a feeling. A bet you’re excited to make, because you believe it’ll pay off.

What most founders get wrong

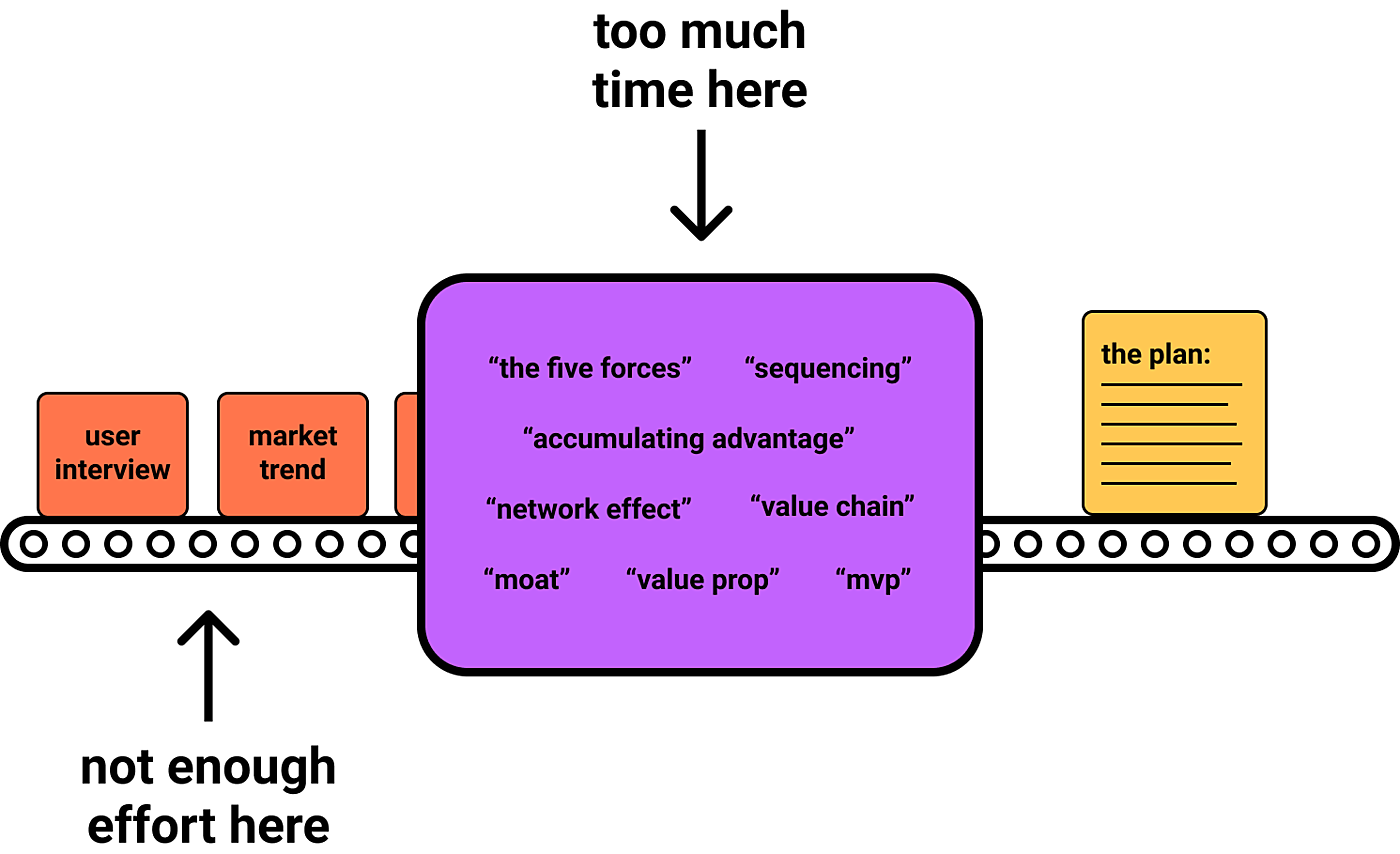

The most common mistake I see is to spend too much time learning the frameworks, and not enough time gathering a high quality and quantity of inputs.

That’s not to say it isn’t good to know something about strategy frameworks. They can be incredibly useful! But the inputs are where your edge is going to come from.

It’s a lot easier to read business books than to go out and talk to customers.

There’s a principle in programming called “GIGO” that explains why the inputs matter so much. It stands for “garbage in, garbage out.” Basically, it means if you feed bad data into an algorithm, it’s always going to give you back a bad result, no matter how good the algorithm is.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!