Food delivery apps have made us a bold promise: order any dish, from nearly any restaurant, at any time.

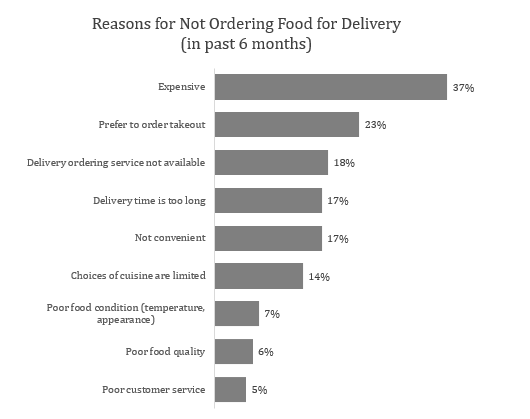

But there is one big problem with their business: the high price. While a single urbanite making a six-figure salary might be able to afford to pay over $20 per person for dinner every night, the majority of the people in the US can’t justify that kind of spend.

(Source: 2PM, December 2019)

However, the consumer trend to order delivery more often is undeniable. It’s been especially prominent in the past few months, due to coronavirus shelter-in-place orders. More people are ordering food through apps than ever before. And many smart people believe that the kitchens in our homes will soon become antiquated, for the same reasons we don’t sew our own clothes anymore. Plus, even after life goes back to normal, it’ll probably be a while before people feel comfortable crowding into restaurants and bars again.

This leads to an interesting problem: there’s something people want (food delivery), but there’s a big barrier for them to purchase it (price).

The price is high not because the restaurants or delivery companies are hoarding profits, but because there are high fixed costs with food delivery. The courier requires a minimum wage. The ingredients can only be so cheap. There just aren’t a ton of things throughout the food delivery value chain that restaurants can innovate on without significant technological advances.

But one way they can innovate is by rearranging the existing component. In particular, by renting space in areas with less foot traffic, businesses can lower one of their biggest expenses: real estate costs.

And if people are ordering food through an app and having it delivered to them, what’s the point of paying for premium retail? What’s the point of employing extra staff to make customers feel comfortable when they enter the restaurant?

This is the problem cloud kitchens are trying to solve. And lots of ambitious entrepreneurs (including ex-Uber CEO Travis Kalanick) believe this is one of the next big trends in food and logistics. And while “cloud kitchens” have only recently become a household term, the concept isn’t completely new.

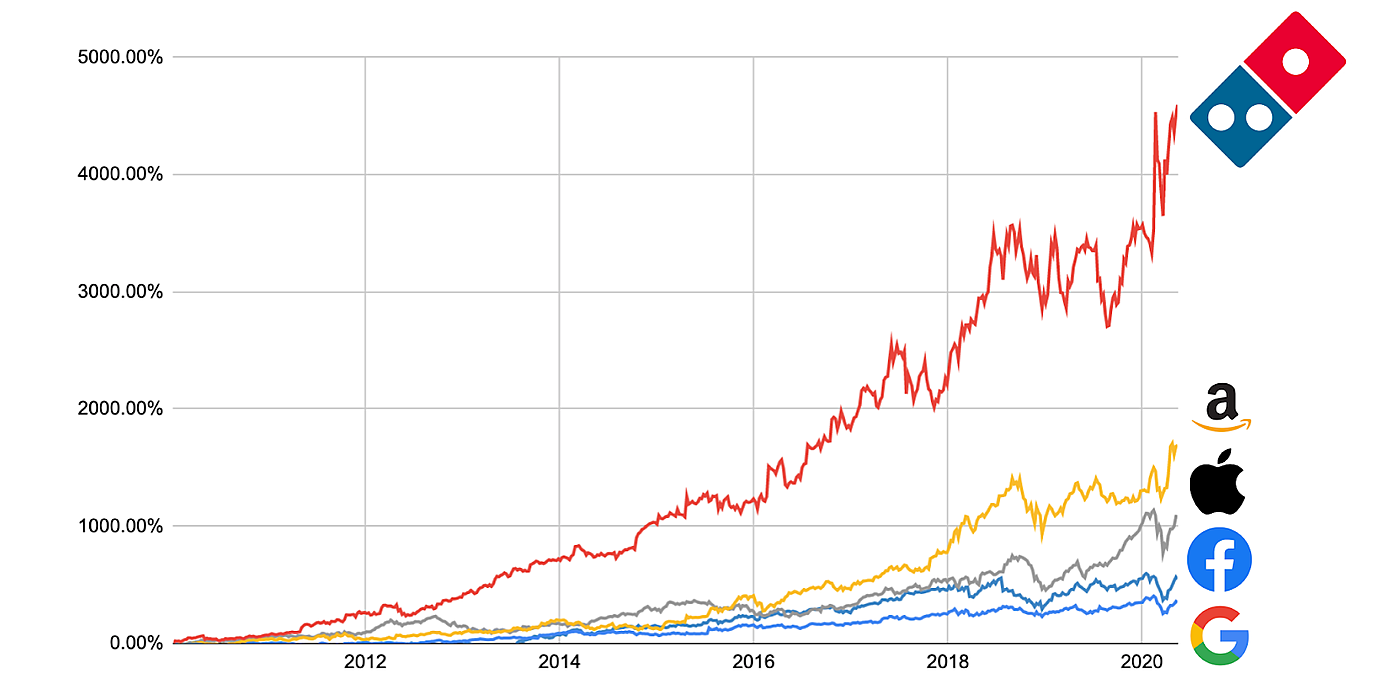

In fact, Domino’s Pizza has been reaping the benefits of cloud kitchens for years.

Think about the similarities between cloud kitchens and Domino’s:

- Stores have small / no dining space and are optimized for delivery

- Location of real estate is focused on the best routes, not the best foot traffic

- Food product travels well and can feed a lot of people for cheap

And while Domino’s is certainly benefiting from the rise of delivery (especially during COVID-19), one of the main reasons they did so well over the past decade has been the alignment of their business and their business model.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!