The TL;DR

- This piece is part of our deep dive into financial metrics and their application. Previous pieces covered Revenue and Cash Conversion Cycle.

- Today we are moving one line down in the income statement to Cost Of Goods Sold. COGS is far trickier than it appears and can act as an indicator of market power. In isolation, it is kinda useless but within the right context can be incredibly powerful.

- Also, in case you missed the announcement, Adam Keesling has moved on from Napkin Math and Evan Armstrong has taken over as Lead Writer. (You can follow updates from Adam on Twitter or on his email list.)

MoviePass is my favorite business of all time. For a brief, glorious period between 2017 & 2018, the company sold an unlimited movie watching membership for <$10. All you had to do was pay the fee and you’d go see all the flicks your heart could possibly desire. My favorite theater in Mountain View, California sold a ticket for a leather recliner for 15 bucks. Essentially, MoviePass was selling dollars for cents. Unsurprisingly, people enjoy being given free things! Their subscribers jumped from 20,000 to 3,000,000 in the span of a year. All of my friends had it. We would go to Century Cinema 16 at least once a week just to chill. Each of us were easily costing MoviePass north of 60 dollars a month, all for the low price of 10 bucks.

As it turns out, giving away money for free is quite stupid. The company burned through tens of millions of dollars and collapsed by 2019. MoviePass is my favorite business because I, the consumer, happily took the clueless executives’ money for my own personal benefit. It was awesome for me, but it sucked for them.

Side Note: There is an argument to be made that MoviePass actually wasn’t a terrible idea! If they had been in the funding environment of today there is a chance they could’ve pulled this off. Get the audience big enough, add advertising on top, plus a pinch of price negotiation with theater companies, and there is a chance this is something. But alas, the Fed had yet to turn on the unlimited money spigot and MoviePass ascended above to the land of dead technology businesses in the sky (this is not the cloud).

Put simply, the cost of the item MoviePass was selling (access to squeaky, sticky seats) exceeded the price they sold it to me for. No matter how cheap they got their servers, no matter how much they streamlined their marketing and operations, they could never turn a profit until they got their revenue to cost of goods sold (COGS) ratio right. Honestly though, we can’t blame them! They didn’t have this newsletter.

So today, we are going to dive deep into COGS. While seemingly an easy concept, it has some serious complications. A thorough understanding will help you be a better business practitioner and (if something as absurd as MoviePass ever comes again) be a better value extracting consumer. Let’s dig in.

How to Spot Cogs in the Wild

MoviePass failed, but there are actually tons of great businesses that lose money for years and are still successful. Pretty much every large tech company over the last decade started off at a loss. Shoot, it took Google three years to get profitable (while simultaneously growing revenue from $220K to $69M). Ergo, MoviePass just needed more time and it obviously would’ve been the next Google. This whole argument, which is dumb btw, is the exact reason COGS was invented. To illustrate why, here is a simple example.

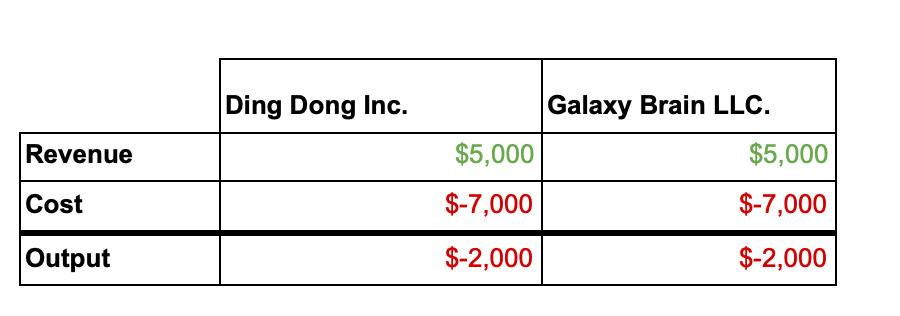

Imagine we are looking at the income statement of two businesses, Ding-Dong Inc. and Galaxy Brain LLC. You are told they both lost $2K in their first year of operation.

“Ah” you say, as you sensually rub your Patagonia vest like it's an investing 8 ball, “these both must be the next Google.”

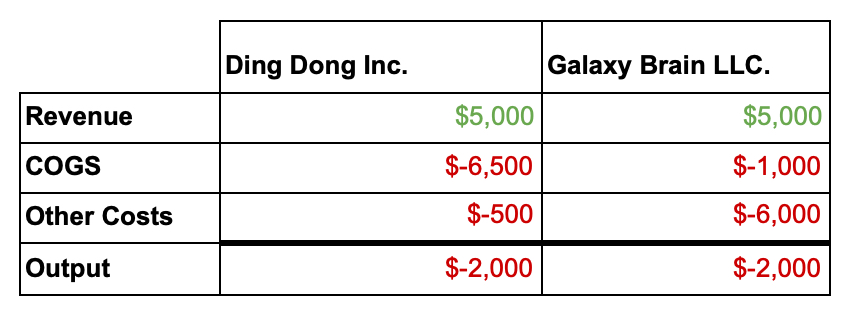

But wait! One of your nerdy, bespectacled interns is a paying Napkin Math subscriber and they send you a revised statement.

Turns out the Ding Dongers are literally selling Ding Dongs (doorbells), for less than it is costing them to create said dongers. Galaxy Brain, in contrast, is selling a bi-directional linking productivity software with a cult-like community (a totally original invention with no competition) and can sell their software with basically no COGS. Now you can see that Galaxy Brain LLC is actually making money for every item they sell! Surely this must be the better business.

It is slightly more nuanced than that. Whether a high COGS % is acceptable or not is dependent on the market/product, but this clarification is the whole point of the income statement. The more minutely and intimately you can understand a business, the more accurately you can assess risk.

To assess the COGS risk, this is probably the point where I tell you the definition.

The Definition of COGS

When you sell something, it tends to cost you money to make that thing. That is the cost of the goods sold (COGS). *Pushes glasses up nose* Specifically, it is the cost associated with the materials and the production of a good that is sold. It does not include the things that are indirectly associated with that sale (marketing, administrative, etc). Different industries may call COGS by different names like Cost of Revenue or Cost of Sales, but we will get to that in a second.

Disclaimer Note: There are resources online that will take you through the accounting methodologies and the specific formula. That is boring so we are skipping it. If you are looking to be 100% compliant use an accountant not a newsletter.

As an example, for a lemonade stand, water, sugar, spit (for spice), and lemons would be the costs directly associated and count as COGS. The more indirect things would be purchasing ads or bribing the city counselors for beverage permits. When companies put together their income statements it would be pretty hard to know what’s going on in the business if all those different types of costs were abstracted into one combined number. For example, it might cost a software business a lot more to get started than a lemonade stand. But unless you know the types of costs they incur, you might make the mistake of thinking the software business is a worse business. Pretty important to know for entrepreneurs and investors! So accountants over time have invented various categorizations that help us distinguish between different types of costs so we can make better predictions about how businesses might perform in the future.

But wait, it’s more complicated than that

One of the guiding rules I have for financial analysis is that there is always another layer. By that, I mean there is always a bit of nuance that the spreadsheet hides. Because rules, definitions, and disclosures in finance are so shifty, what is included in COGS evolves. In my days evaluating startup’s financial documents, I saw people include employee’s snacks in COGS (wrong) the CEO’s salary (also wrong) or the cost for the office dog (cute, but still wrong). Even when a company hires an outside firm to audit, that is no guarantee! What is and isn’t included in various expense lines is always a bit of negotiation. Companies almost always want to add more things below COGS because it makes their business look better.

But this isn’t just a “haha startups are stupid” thing! Public companies do this all the time too! I have many friends who, bless their hearts, became public accountants at EY, Deloitte, etc. They often tell me of their partners having furious negotiations with in-house teams over what should be included or not. Outside of backroom negotiations, you’ll often see companies play around with COGS vs Cost of Revenue vs Cost of Sales. Because these terms aren’t universally agreed upon, they can pick and choose what to include in their term of choice. As an example, let’s take a look at retail companies, which often use cost of sales.

Let’s compare Best Buy and Target. Best Buy put their disclosure on page 53 and Target on page 42 of their most recent respective 10ks. While many of the terms are close to identical, there are several that don’t match up at all. Best Buy has “Payroll and benefit costs for services employees associated with providing the services.” Target has “Compensation and benefit costs associated with shipment of merchandise from stores.” Are those the same? Different? Is Target juicing the numbers or is Best Buy? The important thing to note is there is no way to tell. Definitions or disclosures never appear for those terms. Target’s own note said it best, “The classification of these expenses varies across the retail industry.”

Now to be clear, this isn’t me trying to summon the SEC and proclaim that this is fraud. No, my point is that COGS is not a stable metric. You can’t look at someone’s COGS line and resolutely say that it is true. Like all financial metrics, it is more of narrative guidance. Think of it as a prop that management can use to help tell the story they’d like people to believe about their business. In both the public and private markets, COGS can be used to help understand a business but it can’t be used to tell you everything there is to know.

How does the Market treat COGS?

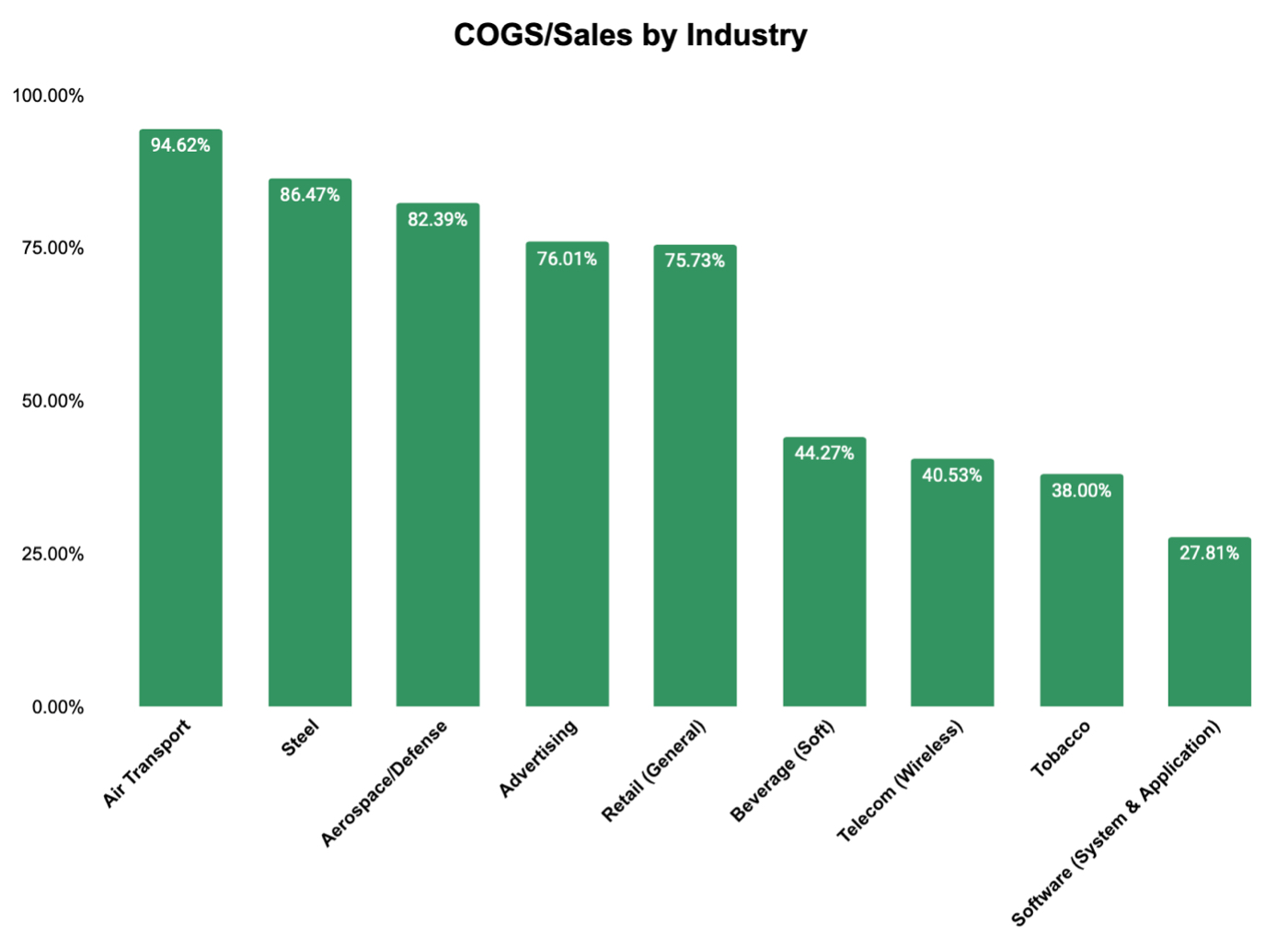

Nevertheless, it is still interesting to compare COGS across industries. Even if the actual components of the COGS are murky there is still directional accuracy when compared across broad cohorts of similar types of companies. NYU’s business school put together a great database with financial performance averages across industries. I made a Google Sheet that you can copy and play around with yourself. Below is a sample of various industries’s COGS/Sales ratio.

This makes intuitive sense. The industries that are “better” should have a better COGS/Sales ratio right? And that should reflect in their valuation too? Well, not quite.

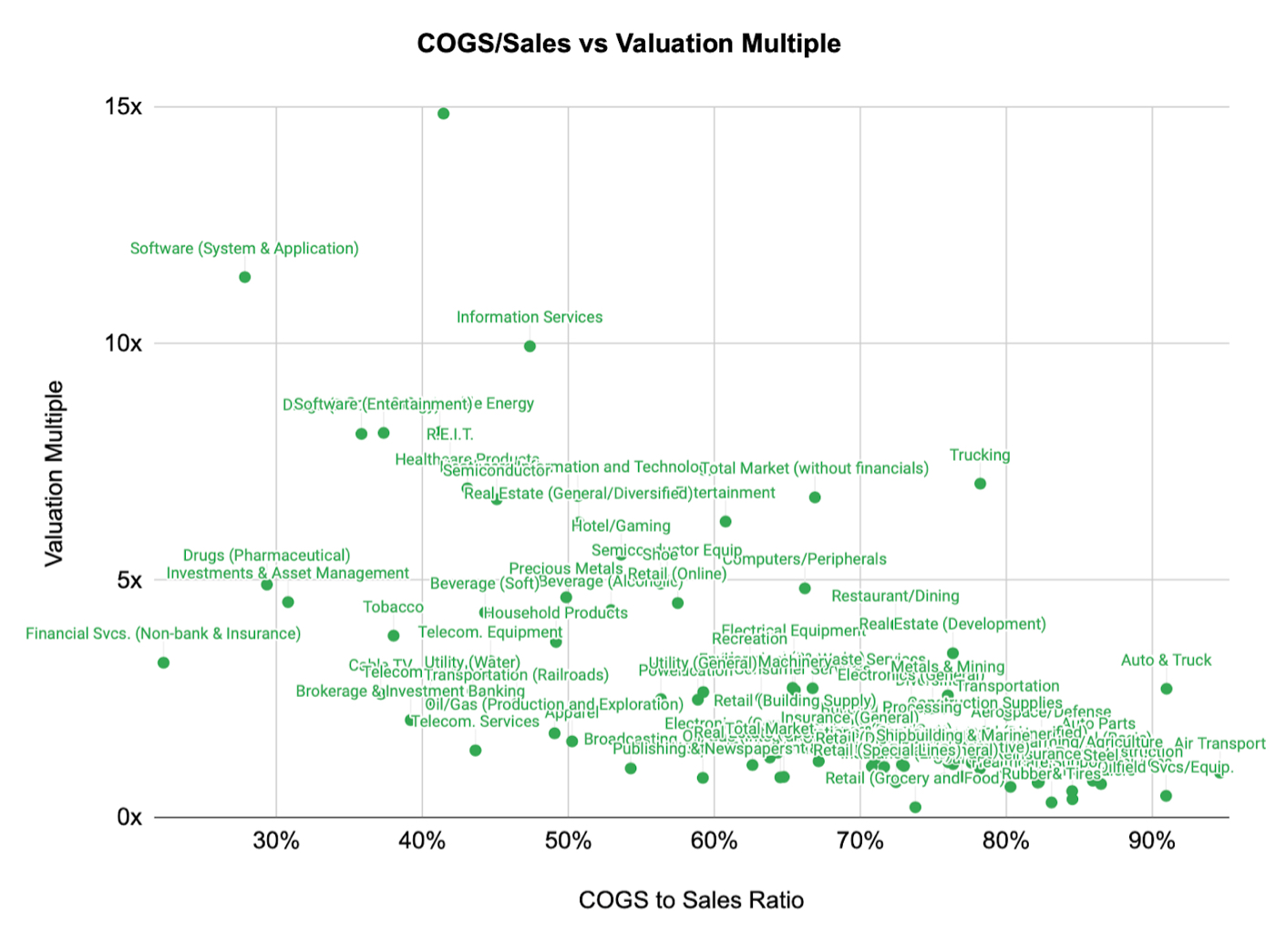

If COGS were an all powerful metric, we should see a tighter correlation between the average industry asset price then what we are seeing in the data above. In some industries the trend holds true like real estate and entertainment. However, there are those that break free of the line of best fit, with technology businesses trading far above what their COGS correlation would say they should.

Investors value a business based on many variables. Of course an important one is gross margins (low COGS relative to revenue), but there are other important factors, like operating expenses (costs of running the business that are more indirect don't get counted in COGS), growth rate, and perceived durability of the business. (Note: Valuation techniques will totally be covered by this publication in the future).

It could be people are confident in an industry (investors are really bullish on the whole technology thing) or there is complete delusion about the long-term prospects of an individual stock (*cough* Gamestop, AMC). Or because this data set was pulled in Jan 2021, COVID made prices so wacky that you can’t take any insight from this at all! Any competent analyst who says they can tell you exactly why the market does what it does is playing you for the fool. I am not that fool and will tell you I don’t know. But you can know that generally the better the long term outlook and financial performance of a sector the higher the price of assets in said sector will be.

Even when you account for sector averages, the companies with superior product cost structures are not necessarily “the best” companies. Some of the most iconic companies today have been built on unashamedly high COGS % (Walmart and Amazon) to attack their respective markets. Adam wrote previously about how Costco sells their goods at incredibly low margins and why that strategy allows them to win. High COGS does not equal a bad company, it just means you are operating on a thinner margin of error. So if you commit to a high COGS % path, be sure you know what you are doing.

A few notes

I wanted to kick off this income statement series in earnest with COGS because it is a perfect exemplar of how I think about finance. Professionals vary between viewing metrics as an inscrutable high science (“well if the finance folks say the IRR works let’s do it”) or something to be completely ignored (see most venture investors).

But to me, studying finance is COMPELLING. It is a glorious, deeply human mystery that whispers its secrets to those who have the patience to dig. Numbers are external indicators of human efforts. They are the magic by which you can discover the history of a business and sometimes, the method by which you can predict its future. I hope that you will continue to explore it with me. If you want to support me on the journey click the subscribe button below.

-e

P.S. I got some of my first breaks in writing because someone took a chance on me. If you have a guest post you would like to write for Napkin Math, send me a pitch. You’ll be paid and our list is large/full of interesting people.

P.P.S. Let me know how this format felt. I can do much more analysis on these numbers from a public markets perspective or give it more narrative flows with stories like MoviePass. Let me know in the comments below!

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!

Hi Evan,

When I learned that focus of Napkin Math changes to deep dives into financial metrics I thought "meh". I've done enough of Financial Analysis during my MSc and when studying for CFA - and there's Investopedia for the rest, right?

But you are doing a great job of explaining a very dry topic like COGS in an easy-to-follow and fun manner - well done. Really enjoyed this, and look forward to more.

Best

Dmytro

@dmytro.ason Thanks Dmytro! Incredibly kind and let me know if there are topics you would like to see covered! Is there anything from you CFA days that you feel like most people misunderstand?

@dmytro.ason Thanks Dmytro! Incredibly kind and let me know if there are topics you would like to see covered! Is there anything from you CFA days that you feel like most people misunderstand?

@ItsUrBoyEvan I think a cool combo would be some metric + a case study of a company that nails it. I remember there was a really cool post about how Gymshark (British sportswear brand) aces negative cash conversion cycle to fund own growth. I am sure there are lots more examples like this for other metrics. Like Peloton and churn, for example (I know churn is not strictly a financial metric, but still). Just a thought!

@ItsUrBoyEvan I think a cool combo would be some metric + a case study of a company that nails it. I remember there was a really cool post about how Gymshark (British sportswear brand) aces negative cash conversion cycle to fund own growth. I am sure there are lots more examples like this for other metrics. Like Peloton and churn, for example (I know churn is not strictly a financial metric, but still). Just a thought!

@ItsUrBoyEvan I think a cool combo would be some metric + a case study of a company that nails it. I remember there was a really cool post about how Gymshark (British sportswear brand) aces negative cash conversion cycle to fund own growth. I am sure there are lots more examples like this. Just a thought!

@dmytro.ason I will definitely be doing the non-financial terms at some point. I'm thinking Net Dollar Retention and snowflake would be cool!

Great work! Love this as a founder who’s very deep into our financials

What a great set of articles on financial statements!

BTW, Is Galaxy Brain referring to Roam research?