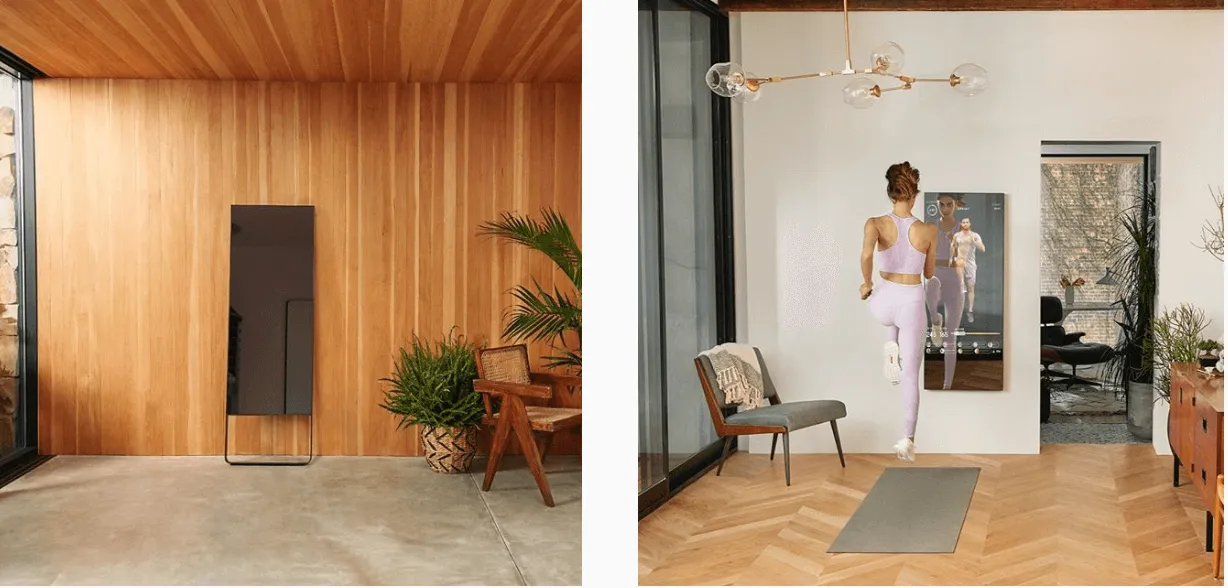

Last week, lululemon acquired the home fitness startup Mirror for $500 million. Mirror sells you the equivalent of a beautiful, giant iPad that hangs on your wall for $1,495. Then, if you pay a $39 monthly subscription, you can use a mobile app to turn the Mirror into a fitness class. Both on-demand and live classes are available for everything from yoga to boxing.

You may be wondering why a company that makes yoga pants is buying a company that makes smart mirrors and fitness videos.

Instead of looking at it that way, consider a different frame. Both companies target the same customer: affluent millennials who like to workout and stare at themselves in a mirror.

Kidding aside, this acquisition makes a lot of sense for lululemon. It goes deeper than simply marketing to the same demographic too. A few reasons why lululemon scooped up Mirror:

- Added a recurring revenue stream (something they didn’t have before)

- Opportunity to cross-sell Mirror to their existing customers

- Earn a spot in the connected home with a new hardware product

And despite these great reasons, there’s also some evidence to suggest that customers might not be all that excited for Mirror.

Was it a good acquisition for lululemon? Or will it flop like so many other cross-sector M&A deals?

Let’s figure it out.

Subscription Hardware

Hardware is not typically a great business. From a post I wrote on Sonos earlier this year:

Consumer durables is a tough business, and hardware is no exception. There are two issues.

First, in a hardware business model, the customer only pays once but extracts value over several years. For Sonos, a customer might buy a speaker for $399 and use it for 10 years without paying Sonos again. Contrast this with a company like Spotify — the customer receives value each month and also pays Spotify $10 each month.

Second, the value proposition doesn’t change much with each cycle upgrade. Cars are a great example of this — most of the value to the customer is having an independent transport that has plenty of storage, includes seating for the family, and is safe. Regardless of whether a car is built in 2010 or 2020, most of those things don’t improve so there’s less of a need to upgrade.

However, Mirror isn’t a typical hardware company: they designed their business with recurring revenue in mind. While Sonos, GoPro and Fitbit struggled (well, are struggling) to start a product line that earns recurring revenue, companies like Mirror were built for it from the start. For $39 per month, subscribers get access to live and on-demand workout classes.

Pure hardware companies like GoPro and Sonos trade around 1x revenue while Peloton (the closest subscription-first public comparison we have to Mirror) is trading at around 11x revenue. With that in mind, lululemon buying Mirror for $500 million — 11.1x their 2019 revenue and 5.0x their 2020 projected revenue — looks like a good deal.

If lululemon were buying a standalone hardware business, I’d be skeptical of their ability to turn it into a stream of subscription revenue. But Mirror immediately gives lululemon a monthly charge on consumers’ credit cards, something they didn’t have before.

Cross-Sell Mirror into lululemon

At first glance, there’s one obvious reason why lululemon purchased Mirror: cross-selling Mirror’s product in the lululemon marketing machine.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

.08.31_AM.png)

Comments

Don't have an account? Sign up!