Hey everyone! This week in Napkin Math we have a guest post from Yiren Lu and Grace Zhang about the upcoming Ant Financial IPO. Hope you enjoy it — let me know what you think in the form at the bottom of the post! — Adam

What: Ant is going public in a $35 billion IPO which would make it the biggest IPO in history. A spin-out of Chinese e-commerce giant Alibaba, they make software products that have democratized access to the financial system in China

When: November 6th

Where: Simultaneous listings on the Shanghai Stock Exchange and the Hong Kong stock exchange

Why is this interesting: The IPO is so massive—this reflects the fact that Ant touches nearly every aspect of Chinese financial life, especially for China’s 250 million unbanked citizens. It is also unique in the sense that Ant chose to list in China rather than in Hong Kong or the US.

✨ History of Ant:

- Ant started out by building the digital payment infrastructure necessary to facilitate transactions on Chinese e-commerce giant Alibaba. As PayPal is to Ebay, Ant is to Alibaba—they are both financial infrastructure companies that grew by facilitating transactions on an existing, popular marketplace.

- After Ant got to scale, they leveraged their user base to bootstrap other initiatives like loans to small merchants, installment payment plans, consumer-friendly financial products, and wealth management services.

- By creating user friendly mobile-first software experiences, Ant is disrupting the traditionally opaque, highly regulated, and hard to access world of Chinese banking. In doing so they have made financial services available to hundreds of millions of Chinese who wouldn’t have previously been able to access them.

💡Ant's Notable Products

Ant doesn’t just make one product—they make several. And their products don’t have easy to understand Western equivalents. Rather, each of their products can be seen as a sort of mash-up of the fintech products familiar in the U.S.

We’ve listed a few of the major products you should know about.

1 - Alipay Mobile Payments

Western Analog: Venmo + Apple Pay + Square.

People in China use Alipay for a variety of everyday transactions like:

- Buying groceries at the grocery store (like Square)

- Sending money to a friend (like Venmo or Apple Pay)

- Giving money to a beggar (like Venmo or Apply Pay—though an uncommon behavior in the U.S.)

- Buying shoes online (like Apple Pay)

- Calling a Didi—the Chinese equivalent of Uber

Because of Alipay, Chinese consumers basically never have to swipe a credit card, pull out a physical wallet, or input payment information into a web form, the way that American consumers do. Every merchant, online and offline, takes Alipay and its main rival WeChat Pay.

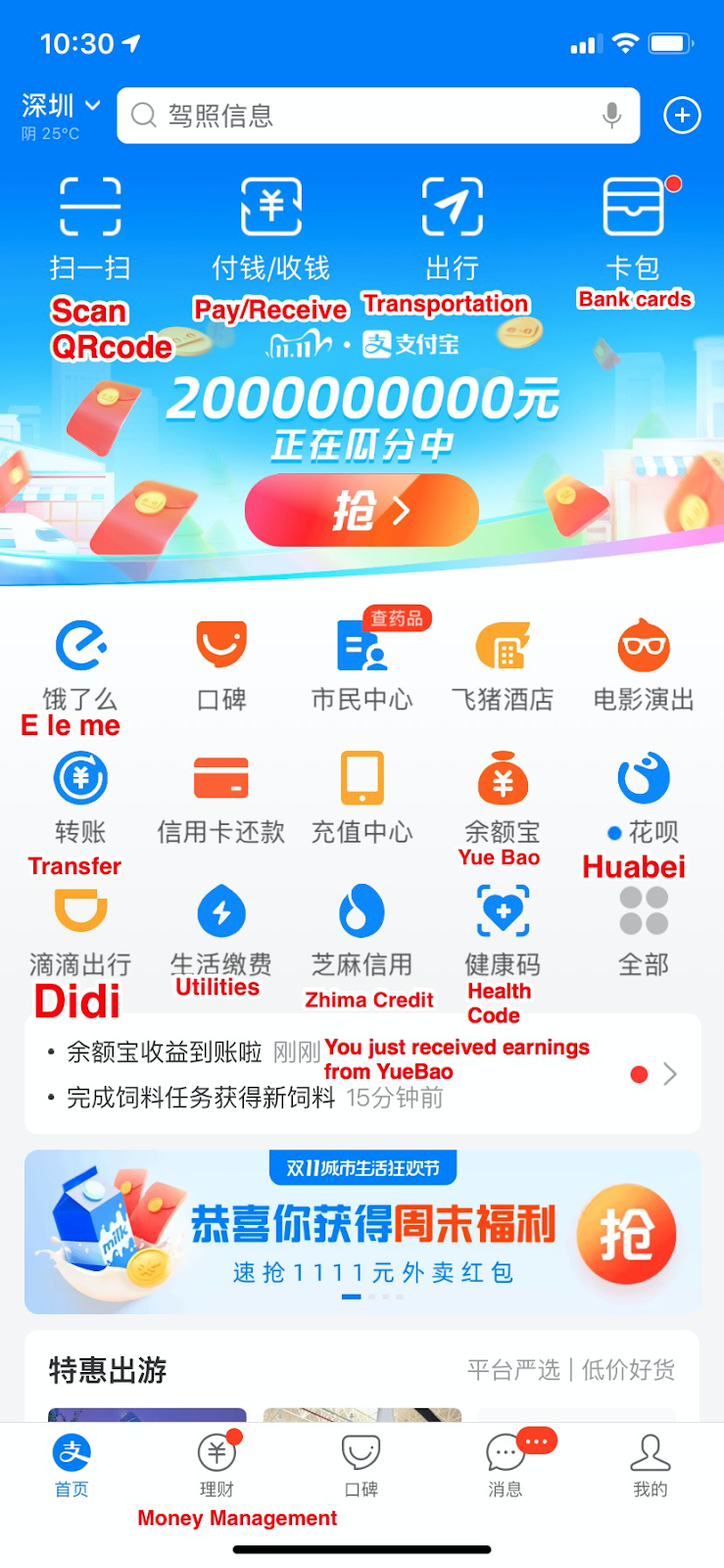

Here’s what the main screen of Alipay looks like—it’s almost like its own operating system:

AliPay also offers support for offline transactions through the use of QR codes. This behavior is much more common in China than in the U.S.

2 — Yu'eBao:

Another one of Ant’s notable products, Yu’eBao is a B2C money market fund launched in 2013.

Western Analog: A Venmo account that pays interest.

Why They Built It: More and more people were holding money in Alipay accounts—in the same way that many Americans have money in their Venmo account.

Ant found a way to allow Chinese consumers to earn interest on this money, rather than letting it sit around, by offering a money-market fund that they could buy into.

In order to do this they had to get around some tricky government regulations that prohibited payment companies from offering interest on their products.

Chinese consumers now effectively use Yu’eBao as a high-yield checking account: they can use it to pay for everyday expenses, and earn interest on their money at the same time.

Thought Bubble: When will their U.S. counterparts try to do the same?

3 — Ant Fortune

Ant Fortune is a B2C wealth management platform launched in 2015.

Western Analog: Robinhood on steroids

Ant Fortune is a natural progression from Yu’eBao: where Yu’eBao simply offers consumers the ability to buy an interest-paying money market fund, Ant Fortune allows consumers to buy a number of financial products offered by banks, asset managers, property insurance orgs, and more:

- Chinese consumers can easily buy mutual funds, CDs, bonds, and insurance on the platform

- Its interface makes it easy for users to find the right financial product for them by automatically matching them with one that fits their criteria—rather than forcing them to understand the financial minutiae of what they’re buying

4 — Ant HuaBei

Ant Huabei is an online credit card issued by Alipay.

Western Analog: credit cards, installment payments like Afterpay and Affirm

- With its access to huge amounts of data on consumption and payment patterns, and in conjunction with the government, Ant has been able to come up with a Zhima (Sesame) credit score for each of its users.

- Depending on their Zhima credit scores, Huabei will provide users with credit lines ranging from RMB 1,000 to RMB 50,000.

🏢 Ant and the Chinese Government

Ant is part of the "shadow banking" system in China, i.e. organizations that are acting as banks (i.e. lending money to SMEs or consumers) but that are not regulated as banks.

The shadow banking system is traditionally where China's 50 million SMEs have accessed credit.

Over the last four years, the government has moved to regulate this sector, by making it easier for banks to compete, and limiting the interest rates that shadow banks can charge.

The government is balancing two competing priorities: innovation and stability.

- Ant serves as useful competition for state-owned financial institutions in terms of innovation and digitization

- The government needs Ant’s distribution channels and technological infrastructure to implement its fiscal policies: for example, local governments using Ant’s Alipay product to issue economic stimulus coupons to local citizens during the pandemic.

- But Ant’s financial products also present new and potentially dangerous levels of risk to the economy—which the government is trying to control with regulation and oversight.

- For example: Zhao Cai Bao, a P2P lending platform launched by Ant in 2014, allowed users to buy corporate bonds and then sell them directly to other users on the platform as personal loans. The problem was that if the original corporate bond defaulted, the losses would cascade. This happened with Chinese telecom conglomerate Cosun in 2016 and a large number of individual investors suffered heavy losses. Zhao Cai Bao has since been shut down.

🔮 What to expect in the future from Ant

Ant is organized into three main lines of business: payments, digital finance, and technology services. Payments and digital finance are mature and established—but technology services is a new horizon of future revenue growth.

In their technology services division, Ant sells fintech infrastructure to legacy financial players who want to undergo “digital transformation” from traditional on-premise infrastructure to cloud computing. This means that Ant built so much technology infrastructure to support their own business they are now selling it to other, older players in the market. It’s very analogous to what Amazon has done with AWS. It also means they have a lot of room to grow.

The concept of Ant leading the way for a full-on modernization of the Chinese financial industry is also consistent with recent remarks made by Jack Ma, the founder and former executive chairman of Alibaba. In it he criticized traditional Chinese banking as backwards, siloed, and relationships-driven. Leveraging technology and big data was the only way forward, he said.

Want to get more China tech briefings?

How did you feel about this post?

News From Around the Bundle

The Everything bundle is growing quickly, and members get automatic access to every new writer, article, and show that gets added. Here are a few you might like:

- How I Spend 5 Minutes A Day on Email, by Nat Eliason in Almanack

- Dealing with Co-Founder Resentment, by Jerry Colonna and Andy Sparks

- Ask a Journalist, a live event on writing with award winning journalist John H. Richardson, hosted by Rachel Jepsen of The Long Conversation (I’ll be there live too!)

Enjoy this post? Subscribe to Napkin Math Premium

We’re striving to make Napkin Math Premium the best possible resource for finance and investing analysis.

When you become a member you’ll get additional in-depth articles only available to subscribers, including:

- How Datadog became the $25 billion leader in Observability

- Why The New York Times is going to continue to grow at breakneck speeds

- Why school bus operators are an overlooked investment opportunity, and a database of 60 companies to get you started

Napkin Math also comes as a bundle, so when you subscribe you also get access to all our other paid newsletters: Divinations, Superorganizers, Praxis, Means of Creation, Ask Jerry, The Long Conversation, Free Radicals, and Almanack.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!