Roll-up strategies are common in private equity, but scarce in startups. They are often executed behind closed doors in antiquated and boring industries. A near-arbitrage investment strategy, there’s no reason for buyout investors to share their ideas. And because they operate in the private markets and require millions in capital to execute, there are few reasons why most people would dig into them.

But recently, at least one startup has learned about this strategy and is capitalizing on it.

Thrasio, a company that buys Amazon third-party private-label businesses, recently raised $260 million in funding, giving it a valuation of over $1 billion. According to the Washington Post, they have over $300 million pro forma trailing twelve months revenue.

At a $1 billion valuation in two years, Thrasio is the fastest profitable company in the U.S. to become a unicorn. In this article, I explore how Amazon Marketplace businesses work, Thrasio’s operating strategy, why they are subject to platform risk, if regulators will intervene if Amazon changes their algorithm, and what a “Thrasio for X” could look like. Let’s get into it.

How Amazon Marketplace Works

Amazon Marketplace is a platform for independent eCommerce sellers and it’s split up between fulfilled by Amazon (FBA) and fulfilled by merchant (FBM). 66% of Marketplace businesses sell only using FBA, 6% sell only using FBM, and the remaining 29% fulfill their products both through Amazon and their own networks (source).

Fulfilled by merchant (FBM) is similar to traditional eCommerce models: the merchant sells a product (in this case through Amazon) and on the backend they handle everything. They buy or manufacture the product, they ship it, they handle customer support and returns. For FBM businesses, Amazon is a marketing channel.

Fulfilled by Amazon (FBA) is a bit different. It works like this: the merchant still sells a product through Amazon, but in this case Amazon does all the fulfillment work. According to their website, Amazon offers shipping, storage, removals and returns. They hold your inventory, monitor it through their tracking system, pack and ship the product, and deal with returns. Many times these businesses have products that are sourced through a Chinese factory, shipped to an Amazon warehouse in the US, then shipped to the customer by Amazon.

With Amazon FBA, it’s entirely possible to start and run an eCommerce store sitting in your basement and wearing your pajamas. It’s a great option for resourceful entrepreneurs, especially those who don’t have other technical skills like programming.

Most of the businesses on Amazon’s third-party marketplace are relatively small. There’s a lot of advice online about how to build these, and one of the most common best practices is to pick a small niche. Products sold by FBA businesses range from blood pressure monitors to hair sprays to children's toys and everything in between.

Amazon Marketplace (where FBM and FBA companies live) is no small business for Amazon. The gross merchandise volume (GMV) of Amazon is $335 billion annually, and $200 billion of that is Amazon Marketplace.

It’s actually been one of the main growth drivers for the retail business and now makes up nearly 60% of all sales on Amazon.com.

(Source)

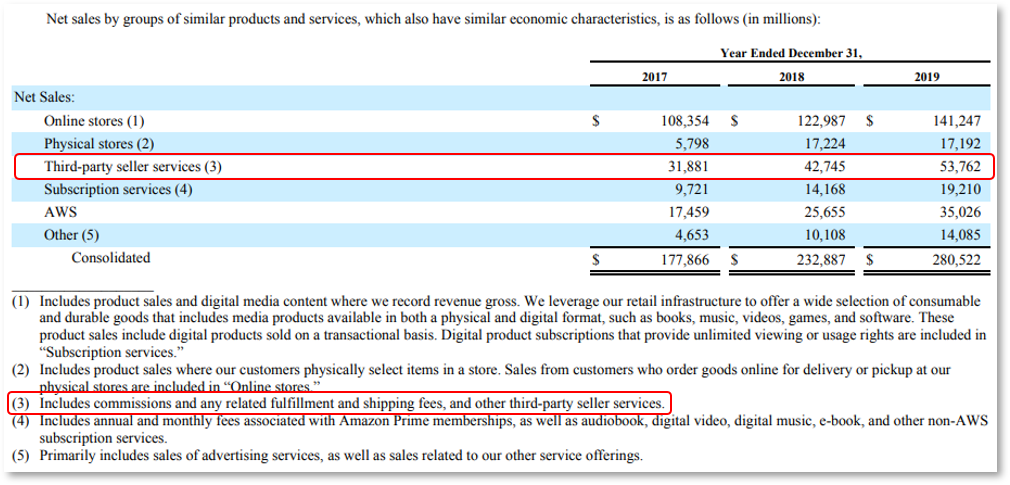

Amazon of course just gets a cut of the marketplace revenue. In 2019, they earned $53.7 billion, implying a ~27% take rate.

(Source: Amazon 2019 Form 10-K)

Thrasio’s Strategy

From the outside, Thrasio’s strategy is simple. They buy under-optimized businesses in a highly-fragmented industry. Then, they improve operations, mash together the backends and either milk the cash flow for dividends or sell at a higher multiple.

As a profitable company with over $300 million in revenue, their plan is working so far (we’ll get to the risks in a minute). It’s working because they can expand their earnings multiple, they’re operating in a large total addressable market (TAM) and they work to build competitive advantages in their business.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!