Disruption Theory is one of those ideas that’s obviously useful, incredibly popular, and likely quite incomplete.

It’s useful because history has repeated the pattern over and over again: powerful incumbents face an existential dilemma when faced with a certain type of new entrant.

But the theory also feels — at least to me, Alex Danco, Ben Thompson, and Hamilton Helmer — like it’s not the whole story. Of course, no theory can predict everything. But at this point the list of exceptions seems to be getting rather long.

For instance:

- How does disruption explain companies like Uber and the iPhone, which succeeded by starting at the high-end of existing markets, which the theory says shouldn’t work?

- How can it account for the perpetual low-end focus of companies like Costco, Wal-Mart, and Southwest Airlines, whom the theory predicts should drift upwards over time?

- And why doesn’t the theory work when applied to certain types of high-end businesses, like luxury, fashion, and higher education, which never seem to get disrupted?

Most importantly, if disruption isn’t the whole story, then what is? What does the theory say, what are its problems, and what new ideas might make it better?

This is the first in a five-part series exploring challenges to disruption, the most popular idea in strategy.

Here’s the roadmap:

- Classic Disruption – what the idea of “disruption” really means, and where it came from. (You are here.)

- Ben Thompson’s “divine discontent” critique — are some user needs impossible to overshoot?

- Alex Danco’s “ecosystem” critique - should we view disruption through the lens of individual companies, or whole ecosystems of interdependent businesses?

- Hamilton Helmer’s razor - are “upmarket” and “downmarket” distinctions helpful? Or should we focus purely on incumbents’ incentive structures?

- The Divinations Synthesis - after weighing all the evidence and parsing all the arguments, what do I believe is true?

Sound good? Let’s get started.

Classic Disruption

Disruption Theory describes a weak spot that big companies have and a process that startups can use to exploit it.

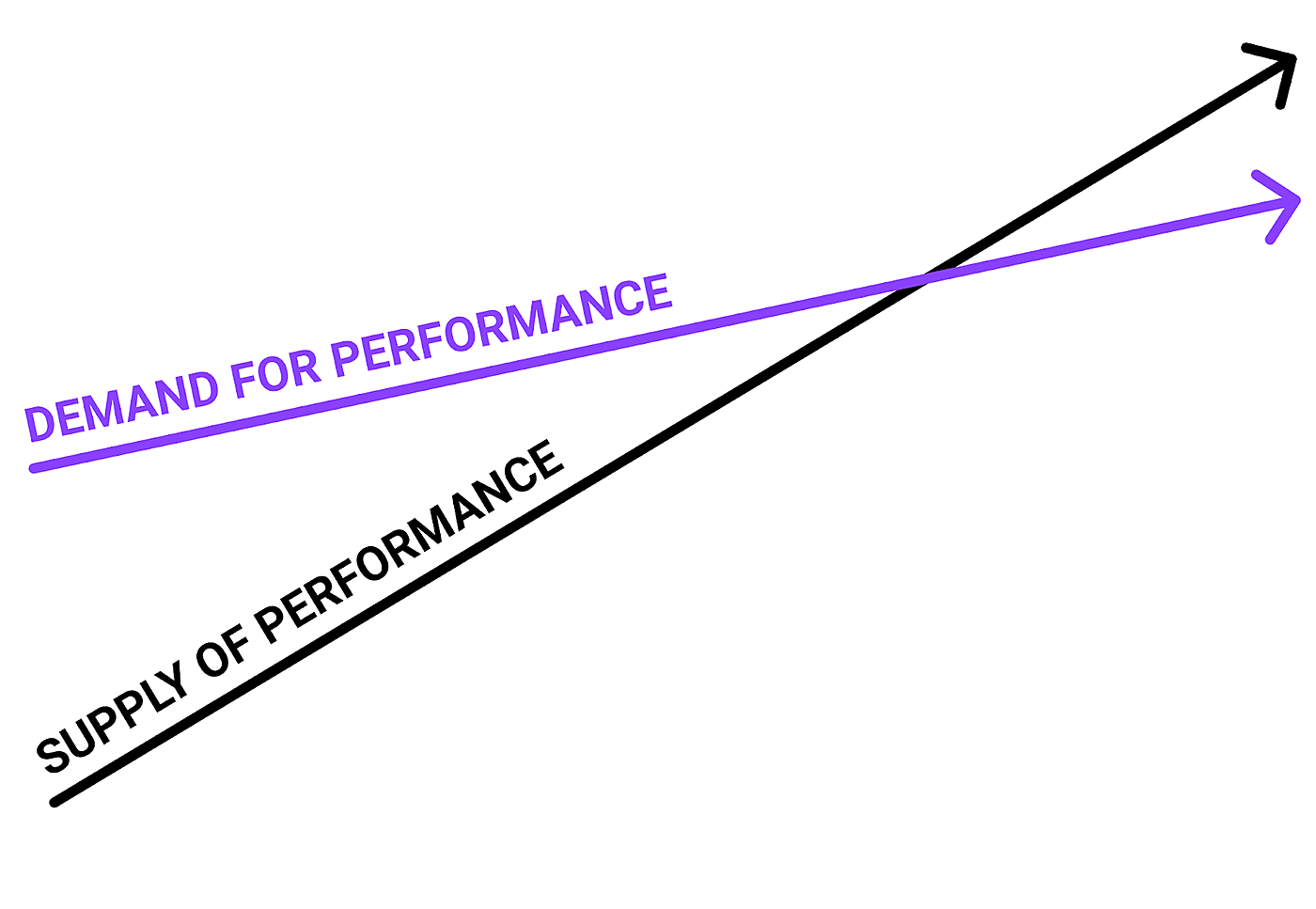

It says that powerful incumbents tend to prioritize their most demanding and profitable customers, and move up-market over time. This leaves an opening for startups to serve buyers who require less performance, or who aren’t participating in the market at all because it’s too expensive, complicated, or inconvenient.

This would be fine, except in some markets the startups are able to improve their technology to the point where they can serve the low and high end of the markets. As these new entrants gain momentum and improve their technology, they often move up-market and become an existential threat to the incumbent.

Before Clay Christensen, most people assumed this weak spot existed because big company managers made dumb decisions. But Christensen was more generous (and realistic) than that. These same people, after all, were glorified as geniuses when their companies were on the rise! So he went looking for a more convincing explanation.

He studied industries like disk drives, steel mills, dirt excavators, and computers, and saw a similar pattern in each: leading companies often followed a trajectory of performance improvement that would overshoot their customers’ needs.

The Only Subscription

You Need to

Stay at the

Edge of AI

The essential toolkit for those shaping the future

"This might be the best value you

can get from an AI subscription."

- Jay S.

Join 100,000+ leaders, builders, and innovators

Email address

Already have an account? Sign in

What is included in a subscription?

Daily insights from AI pioneers + early access to powerful AI tools

Comments

Don't have an account? Sign up!